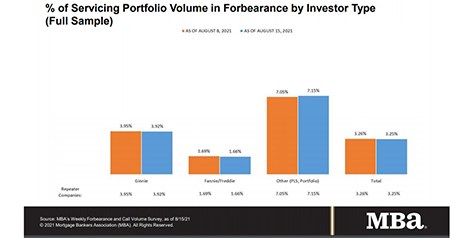

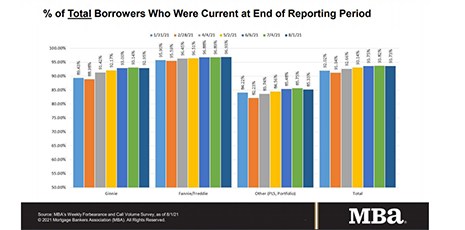

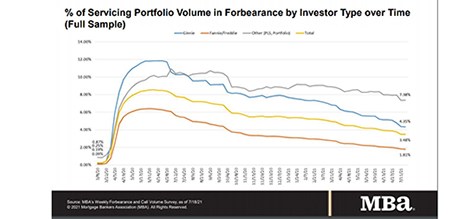

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 3.25% of servicers’ portfolio volume as of August 15 from 3.26% the week prior. MBA estimates 1.6 million homeowners are in forbearance plans.

Tag: MBA Forbearance and Call Volume Survey

Share of Mortgage Loans in Forbearance Dips to 3.25%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 3.25% of servicers’ portfolio volume as of August 15 from 3.26% the week prior. MBA estimates 1.6 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 3.40%

New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Decreases to 3.40%

New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.

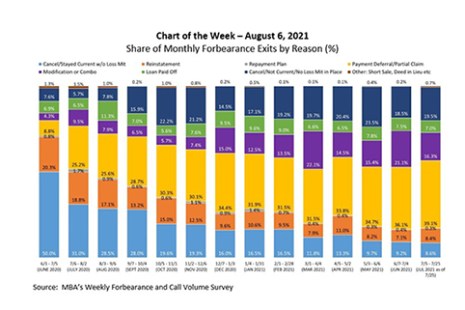

MBA Chart of the Week Aug. 9, 2021: Share of Monthly Forbearance Exits by Reason

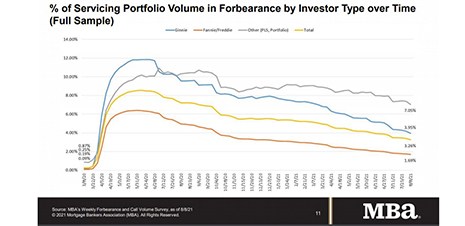

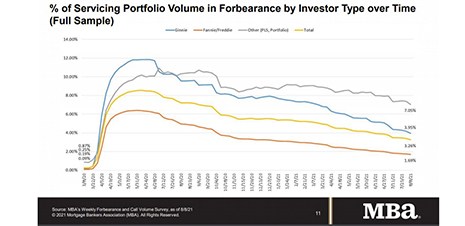

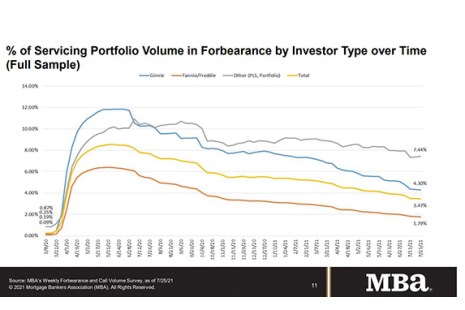

According to MBA’s Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 3.47 percent of servicers’ portfolio volume as of July 25, 2021, from a peak of 8.55 percent as of June 7, 2020. While the number of borrowers exiting forbearance has fluctuated from one month to the next, with the largest number of reported exits in July and October of last year, the post-forbearance outcomes for borrowers have differed.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.