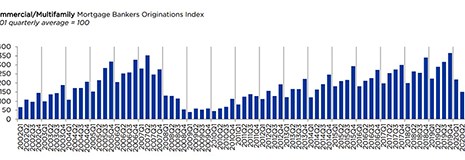

Commercial and multifamily mortgage bankers closed $683.2 billion of loans in 2021, the Mortgage Bankers Association reported Thursday. MBA estimated total CRE lending including activity from smaller and mid-sized depositories totaled $890.6 billion.

Tag: MBA Commercial/Multifamily Mortgage Bankers Originations Report

MBA: 2022 Commercial/Multifamily Mortgage Maturity Volumes to Increase 12 Percent

SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

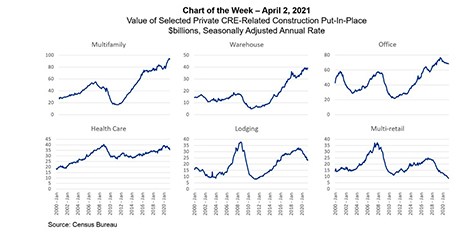

MBA Chart of the Week Apr. 5, 2021: Value of CRE Construction

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Andrew Foster: CMBS Market Musings

Taken together, the analysis from industry thought leaders indicates that CMBS will continue to have challenges with existing loans through 2021 as new issuance remains robust for agency MBS and at a tepid pace for conduit transactions. Challenges with maturing loans are starting as well; however, 2022 will bring a major wave of those loans.