First American Chief Economist Mark Fleming examines the broad-based improvement in affordability nationally and explains why it’s improving much faster in some markets than in others.

Tag: Mark Fleming

House-Buying Power Jumps Nearly 10% Annually

First American Chief Economist Mark Fleming breaks down why affordability continued its gradual improvement for the ninth consecutive month in November 2025 and the outlook for affordability moving forward.

First American: Affordability Improves to Best Level in Three-Plus Years

Cooling home price growth has helped boost affordability to its best level since the summer of 2022, according to First American, Santa Ana, Calif.

First American: National House Price Growth Stabilizes in Low Single Digits

Annual house price appreciation remained below 1% for the fourth consecutive month during November, according to First American Data & Analytics, Santa Ana, Calif.

Cooling National House Prices Mask Regional Differences, First American Reports

Annual house price appreciation has slowed for 10 consecutive months, but pricing trends vary significantly by region, according to First American Data & Analytics, Santa Ana, Calif.

Price Growth Slows Further in August, First American Reports

House price growth slowed further in August, offering some relief for buyers, First American Data & Analytics said in its Monthly Home Price Index Report.

Affordability’s Slow Comeback

For prospective buyers who have been waiting on the sidelines, the housing market is finally starting to listen, First American Chief Economist Mark Fleming writes.

Today’s Pace of Home Sales is Weaker Than Many Realize

Mark Fleming, chief economist at First American, writes that comparing the pace of home sales today to past decades without considering the growing number of households is misleading.

November Job Growth Exceeds Expectation

November’s job creation bounced back from October and exceeded consensus estimates.

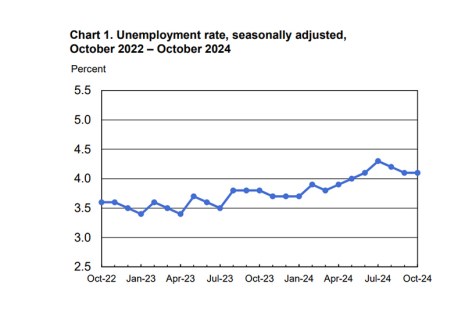

BLS: Jobs Close to Flat in October

Total nonfarm payroll inched up by just 12,000 in October, and the unemployment rate was unchanged at 4.1%, per the U.S. Bureau of Labor Statistics.