GRAPEVINE, Texas–MBA’s Joel Kan and Marina Walsh, CMB, took to the main stage at MBA’s Servicing Solutions Conference and Expo to address their economic outlook and how that impacts mortgage servicing.

Tag: Marina Walsh

Chart of the Week: Mortgage Delinquency Rate by Loan Type

According to MBA’s National Delinquency Survey, mortgage delinquencies increased across all three major loan types–Conventional, FHA, and VA–in the last three months of the year.

Access to Research: Make Data-Informed Decisions Webinar, Jan. 23

On Friday, January 23 from 1:00 PM–2:00 PM EST, demystify the market data and learn exactly how to use your benefits to your advantage in this free webinar.

Chart of the Week: Employee Benefits Costs for Mortgage Lenders, Servicers

The beginning of the year brings changes to employee benefits and associated costs for both mortgage company employers and employees.

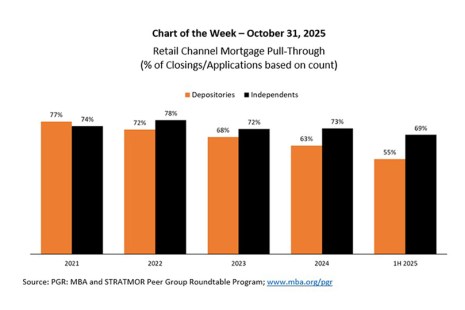

Chart of the Week: Retail Channel Mortgage Pull-Through

At last month’s MBA Annual Convention and Expo in Las Vegas, lenders discussed and debated ways to reduce origination costs and increase productivity by investing in more modern technology, refining the use of technology, and making the loan production process more efficient. Improved servicing recapture and offering a greater variety of non-agency loan products were also explored as ways to achieve scale and spread fixed costs over more origination volume.

MBA Forecast: Total Single-Family Mortgage Originations to Increase 8% to $2.2 Trillion in 2026

The Mortgage Bankers Association announced at its 2025 Annual Convention and Expo that total single-family mortgage origination volume is expected to increase to $2.2 trillion in 2026 from $2.0 trillion expected in 2025.

MBA Forecast: Total Single-Family Mortgage Originations to Increase 8% to $2.2 Trillion in 2026

The Mortgage Bankers Association announced at its 2025 Annual Convention and Expo that total single-family mortgage origination volume is expected to increase to $2.2 trillion in 2026 from $2.0 trillion expected in 2025.

Mortgage Delinquencies Decrease Slightly in the Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.93% of all loans outstanding at the end of the second quarter, according to MBA’s National Delinquency Survey.

Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.04% of all loans outstanding at the end of the first quarter, according to MBA’s National Delinquency Survey.

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.36% in March

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 2 basis points from 0.38% of servicers’ portfolio volume in the prior month to 0.36% as of March 31, 2025.