With the impending LIBOR transition, one of the remaining sticky issues for lenders is how to calculate and implement the replacement or fallback rate for adjustable-rate mortgages. Learn from MBA and industry experts on how companies should be navigating the potential operational hurdles, reporting and disclosure requirements, and what investor expectations will be for these loans.

Tag: LIBOR

Fannie Mae, Freddie Mac Announce Replacement Rates for Legacy LIBOR Products

The replacement indices are the benchmark replacements recommended by the Federal Reserve Board and are based on the Secured Overnight Financing Rate (SOFR). The transition to these replacement indices will occur the day after June 30, 2023

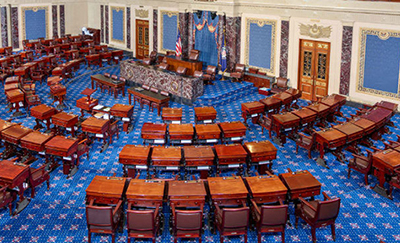

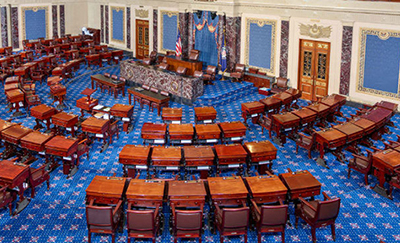

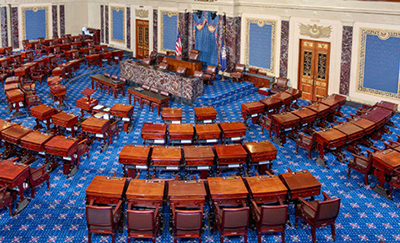

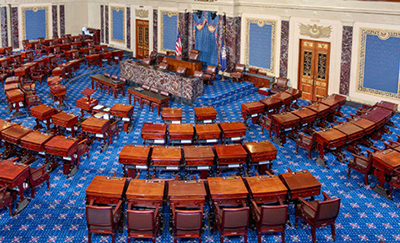

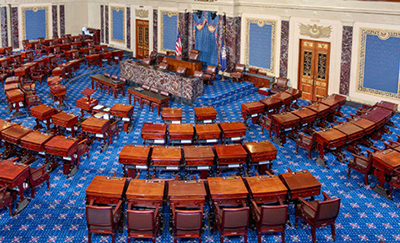

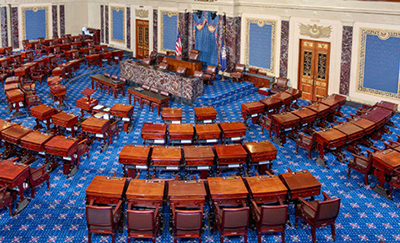

Tester, Tillis Introduce LIBOR ‘Tough Legacy’ Bill; MBA, Trade Groups Urge Senate Support

Sens. Jon Tester, D-Mont., and Thom Tillis, R-N.C., yesterday introduced a bill that addresses “tough legacy” contracts that currently reference LIBOR. The Mortgage Bankers Association and more than two dozen industry trade groups sent a letter to Senate leadership in support of the bill.

Tester, Tillis Introduce LIBOR ‘Tough Legacy’ Bill; MBA, Trade Groups Urge Senate Support

Sens. Jon Tester, D-Mont., and Thom Tillis, R-N.C., yesterday introduced a bill that addresses “tough legacy” contracts that currently reference LIBOR. The Mortgage Bankers Association and more than two dozen industry trade groups sent a letter to Senate leadership in support of the bill.

MBA, Trade Groups Urge Senate Support of ‘Tough Legacy’ LIBOR Bill

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

MBA, Trade Groups Urge Senate Support of ‘Tough Legacy’ LIBOR Bill

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

MBA, Trade Groups Urge Senate Support of ‘Tough Legacy’ LIBOR Bill

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

MBA, Trade Groups Urge Senate Support of ‘Tough Legacy’ LIBOR Bill

The Mortgage Bankers Association and more than a dozen industry trade groups on Monday urged Senate leadership to support legislation that would address “tough legacy” contracts that currently reference the soon-to-expire London InterBank Offered Rate.

MBA, Trade Groups Ask House Approval of Bill Addressing LIBOR ‘Tough Legacy’ Contracts

The Mortgage Bankers Association and nearly two dozen industry trade groups asked House leaders to secure approval of legislation that would address “tough legacy” contract that currently reference the soon-to-be-obsolete London InterBank Offered Rate.

MBA, Trade Groups Urge HUD to Issue ‘Clear Roadmap’ for Servicers in LIBOR Transition

As HUD considers changes to its index for FHA-insured adjustable-rate mortgages away from LIBOR, the Mortgage Bankers Association and other industry trade groups urged the Department to issue a clear roadmap for servicers of FHA-insured ARMs, including specification of a replacement comparable index or indices for existing mortgages, as well as guidance on communications with borrowers.