nCino, Wilmington, N.C., announced it will acquire SimpleNexus, Lehi, Utah, for $1.2 billion.

Tag: LBA Ware

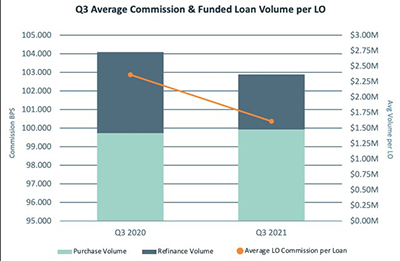

Waning Refi Volumes Spur Decline in LO Commissions

SimpleNexus, Lehi, Utah, said declining loan volumes in the third quarter pushed quarterly loan originator commission earnings by 17%.

Industry Briefs Oct. 20, 2021: SimpleNexus Acquires LBA Ware

SimpleNexus, Lehi, Utah, announced its acquisition of software firm LBA Ware, Macon, Ga. The transaction, SimpleNexus’ first, brings together 325 employees in 29 states to serve 425 distinct lender customers and dozens of mortgage technology integration partners.

Industry Briefs Sept. 24, 2021: CFPB Says Renters at Risk as COVID Safety Net Ends

The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

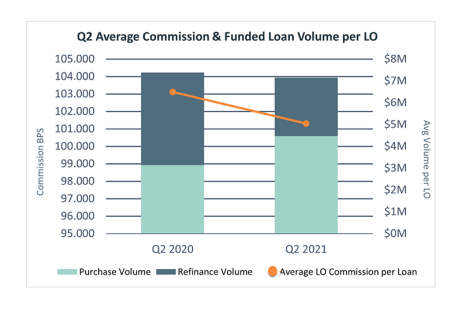

Mortgage Loan Compensation Report Shows Decline in LO Commissions, Volume

LBA Ware, Macon, Ga., said mortgage industry loan compensation per loan originator declined in the second quarter despite a marginal increase in loan volume from Q2 2020 to Q2 2021.

Industry Briefs June 18, 2021

Fannie Mae, Washington, D.C., said economic growth expectations for full-year 2021 were revised modestly upward to 7.1 percent, one-tenth higher than the previous forecast, due to stronger-than-expected consumer spending data year to date.

Industry Briefs May 3, 2021

The Consumer Financial Protection Bureau took action against Nationwide Equities Corp. for sending deceptive loan advertisements to hundreds of thousands of older borrowers.

The Week Ahead—May 3, 2021

The Mortgage Bankers Association’s National Advocacy Conference is a little more than a week away. Offered through MBA LIVE, this is the largest advocacy event of the year focused solely on the issues facing you and the real estate finance industry.

Industry Briefs Mar. 30, 2021

Embrace Home Loans, Lehi, Utah, announced plans to roll out SimpleNexus, a homeownership platform for loan officers, borrowers, real estate agents and settlement agents, to more than 300 retail mortgage LOs before the end of the year.

Lori Brewer: Lender Staffing Data Signals Need to Automate Back Office and Monitor Performance

Lenders hiring their way through spikes in volume, as they have for decades, is a suboptimal, efficiency-draining reaction — not a strategic business decision. Any time lenders hire to manage temporary spikes in volume they reduce profitability, add enterprise risk and pour valuable internal resources into a hiring-firing routine that can destabilize and discourage an entire organization long after volume has normalized.