MBA NewsLink recently convened a roundtable discussion with KBRA Managing Directors Fred Perreten, Alan Greenblatt and Adeeti Amin to examine how data center issuance has evolved in recent years.

Tag: KBRA

NewsLink Q&A With KBRA: 2026 U.S. CMBS Outlook

MBA NewsLink recently interviewed Kroll Bond Rating Agency’s Larry Kay and Aryansh Agrawal about their 2026 commercial mortgage-backed securities outlook.

KBRA: Self-Storage Outperforms Despite Headwinds

Kroll Bond Rating Agency, New York, reported the self-storage sector has been one of the best-performing property types in commercial mortgage-backed securities, even while facing headwinds in the last two years.

MBA NewsLink Multifamily Roundtable: Rents, Ratings and Refinancings

MBA NewsLink recently interviewed three executives about shifting dynamics in multifamily finance, investment and credit ratings.

KBRA Says CMBS 2.0 Office Exposure Rising

Kroll Bond Rating Agency, New York, reported the five-year trend of conduit office exposure declining reversed in first quarter, with exposure rising to 16.3% from 13.9% in Q1 2024 and 15.4% for the full-year 2024.

CRE CLO Resurgence: A Conversation with KBRA’s Christina Moy & Margit Grejdus

MBA Newslink recently interviewed Kroll Bond Rating Agency’s Christina Moy and Margit Greydus about commercial real estate collateralized loan obligations credit from their vantage points handling new issuance and surveillance credit ratings.

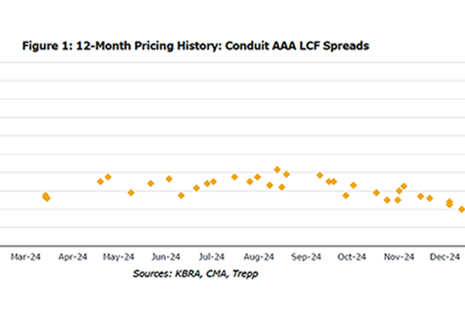

KBRA: CMBS Ends 2024 on High Note

KBRA, New York, reported commercial mortgage-backed securities ended the year on a high note, as issuance exceeded $100 billion in 2024—a level experienced only once since the global financial crisis.

NewsLink Roundtable: The Top CMBS Issues to Watch in 2025

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.

Top CMBS Issues in 2025: An MBA NewsLink Roundtable

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.

Top CMBS Issues to Watch in 2025: An MBA NewsLink Roundtable

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives to explore their perspective on the industry landscape in the new year.