Despite a jump in key mortgage interest rates, mortgage applications increased from one week earlier, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending September 18.

Tag: Joel Kan

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications fell for the fourth time in five weeks even as key interest rates held near record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending September 11.

Mortgage Applications Dip in MBA Weekly Survey

Mortgage applications fell for the fourth time in five weeks even as key interest rates held near record lows, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending September 11.

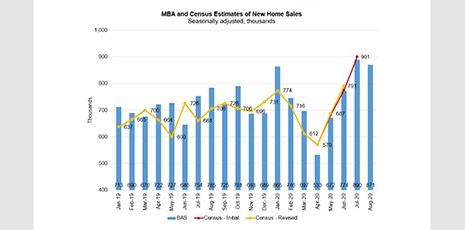

MBA: August New Home Purchase Apps Down 4% from July, Up 33% From Year Ago

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

MBA August New Home Purchase Apps Down 4% from July, Up 33% From Year Ago

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

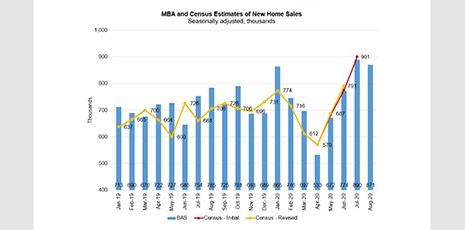

Mortgage Credit Availability Decreased in August

Mortgage credit availability decreased in August according to the Mortgage Credit Availability Index, a Mortgage Bankers Association report that analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 4.

Mortgage Applications Down for 3rd Straight Week in MBA Weekly Survey

Mortgage applications fell for the third straight week even as interest rates dipped again, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 28.

Mortgage Applications Down for 3rd Straight Week in MBA Weekly Survey

Mortgage applications fell for the third straight week even as interest rates dipped again, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 28.

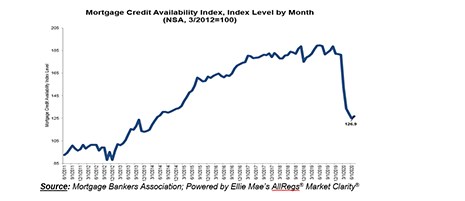

MBA Chart of the Week: Home Sales and Purchase Applications

As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.