A 31-basis-point drop in mortgage interest rates brought home buyers—and refinancers—out of the woodwork last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending July 29.

Tag: Joel Kan

MBA Weekly Survey Aug. 3, 2022: Sharp Drop in Rates Drives Up Applications Activity

A 31-basis-point drop in mortgage interest rates brought home buyers—and refinancers—out of the woodwork last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending July 29.

MBA Weekly Survey July 27, 2022: Mortgage Applications Decrease Again

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 22, 2022.

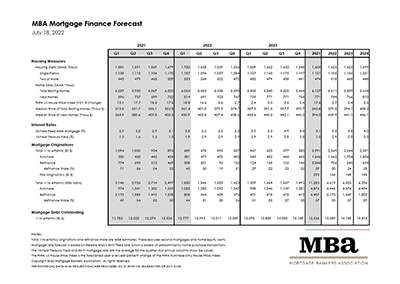

MBA Updates Economic, Mortgage Market Forecasts

The Mortgage Bankers Association released updated Economic and Mortgage Market forecasts Thursday.

MBA Weekly Survey July 20, 2022: Mortgage Applications Decrease

Mortgage applications decreased 6.3 percent from one week earlier, reported the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 15, 2022.

MBA Weekly Survey July 20, 2022: Mortgage Applications Decrease

Mortgage applications decreased 6.3 percent from one week earlier, reported the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 15, 2022.

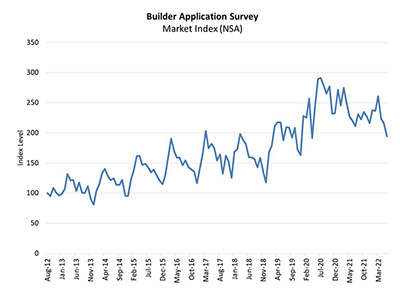

June Purchase Mortgage Applications for New Homes Decreased 12%

Mortgage applications for new home purchases decreased 12 percent compared to a year ago, the Mortgage Bankers Association’s Builder Application Survey reported.

MBA Weekly Survey July 13, 2022: Applications, Rates See Little Change

Mortgage applications fell for the second straight week, albeit only slightly, and key interest rates were unchanged, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending July 8.

MBA Weekly Survey July 13, 2022: Applications, Rates See Little Change

Mortgage applications fell for the second straight week, albeit only slightly, and key interest rates were unchanged, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending July 8.

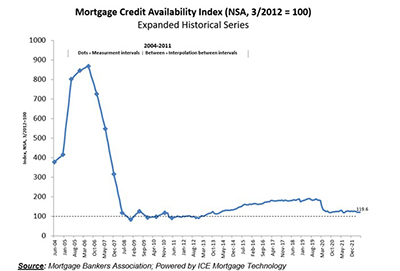

June Mortgage Credit Availability Declines

Mortgage credit availability fell for the fourth straight month in June amid rising interest rates, the Mortgage Bankers Association reported Tuesday.