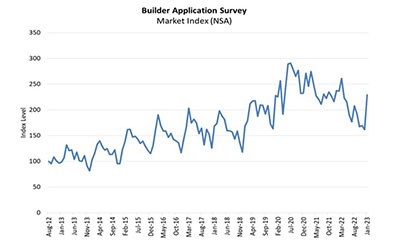

Mortgage applications for new home purchases in January jumped by 42 percent from December but fell by 3.5 percent from a year ago, the Mortgage Bankers Association reported Friday.

Tag: Joel Kan

MBA Weekly Survey Feb. 15, 2023: Rising Rates Push Down Applications

After falling for the past five weeks, mortgage interest rates jumped by nearly a quarter percentage point last week, dampening mortgage application activity, the Mortgage Bankers Association reported Wednesday.

MBA Weekly Survey Feb. 15, 2023: Rising Rates Push Down Applications

After falling for the past five weeks, mortgage interest rates jumped by nearly a quarter percentage point last week, dampening mortgage application activity, the Mortgage Bankers Association reported Wednesday.

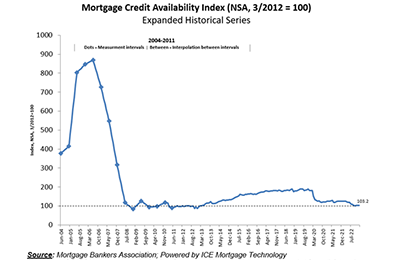

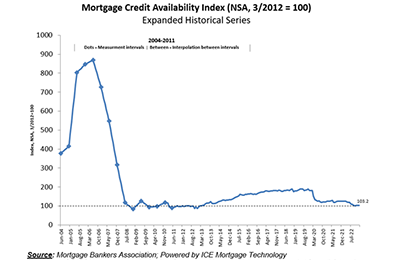

January Mortgage Credit Availability Flat for 2nd Straight Month

Mortgage credit availability fell by just 0.1 percent in January and has held flat for the past two months, the Mortgage Bankers Association reported Thursday.

January Mortgage Credit Availability Flat for 2nd Straight Month

Mortgage credit availability fell by just 0.1 percent in January and has held flat for the past two months, the Mortgage Bankers Association reported Thursday.

MBA Weekly Survey Feb. 8, 2023: Applications Up; Rates Down 5th Straight Week

Mortgage applications rose last week as interest rates inched lower for the fifth straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending February 3.

MBA Weekly Survey Feb. 8, 2023: Applications Up; Rates Down 5th Straight Week

Mortgage applications rose last week as interest rates inched lower for the fifth straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending February 3.

MBA Weekly Survey Feb. 1, 2023: Applications Drop Despite 4th Week of Falling Rates

Mortgage applications fell from one week earlier despite another drop in interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 27.

MBA Weekly Survey Feb. 1, 2023: Applications Drop Despite 4th Week of Falling Rates

Mortgage applications fell from one week earlier despite another drop in interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending January 27.

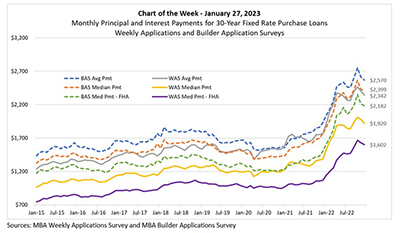

MBA Chart of the Week, Jan. 27, 2023: Monthly Principal, Interest Payments

In Thursday’s MBA Purchase Applications Payment Index (PAPI) release, MBA Research introduced a new measure—The Builders’ Purchase Applications Payment Index (BPAPI).