Real Capital Analytics, New York, said commercial real estate price growth eased in March from its previous record high.

Tag: Jim Costello

Commercial Real Estate Not Yet Out of the Woods

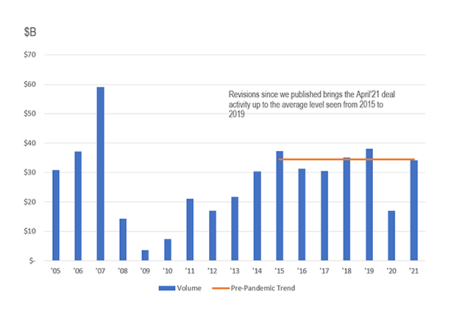

U.S. commercial real estate investment increased in April, but not all pandemic-related problems are in the rearview mirror, reported Real Capital Analytics, New York.

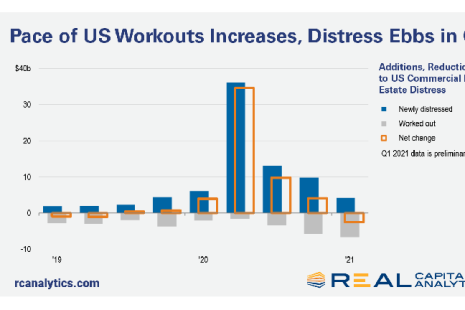

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

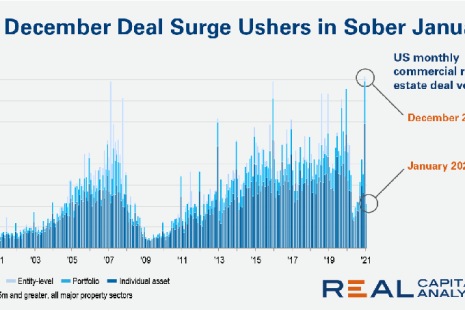

CRE Deal Activity Drops in January After Record December

Real Capital Analytics, New York, reported commercial real estate deal activity dropped significantly in January after a year-end surge in apartment, industrial and office sales.

CMBS Market Musings–Not Out of the Woods?

As the commercial real estate finance market experienced fits and starts last year, no capital source provided more transparency into commercial real estate than CMBS with its monthly investor reporting and credit rating agency coverage creating a window into market performance and challenges for certain retail and hospitality assets.

CMBS Market Musings–Not Out of the Woods?

As the commercial real estate finance market experienced fits and starts last year, no capital source provided more transparency into commercial real estate than CMBS with its monthly investor reporting and credit rating agency coverage creating a window into market performance and challenges for certain retail and hospitality assets.

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Europe Surpasses U.S. as Commercial Real Estate Investment Leader

The U.S. is generally the largest and most liquid region for commercial real estate deal activity, but Europe surpassed the U.S. for investment in the second quarter, reported Real Capital Analytics, New York.