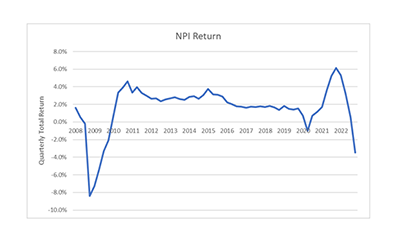

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned -3.50% for the fourth quarter, the first negative return since the 2020 COVID pandemic and the largest since the Great Recession.

Tag: Jamie Woodwell

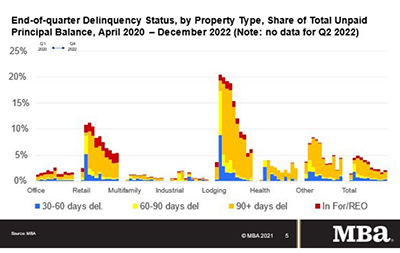

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rates Increase

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly through the fourth quarter, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rates Increase

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly through the fourth quarter, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

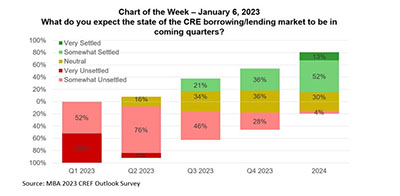

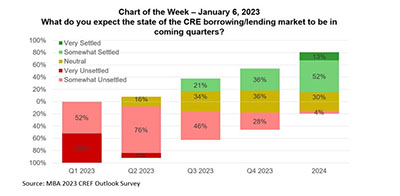

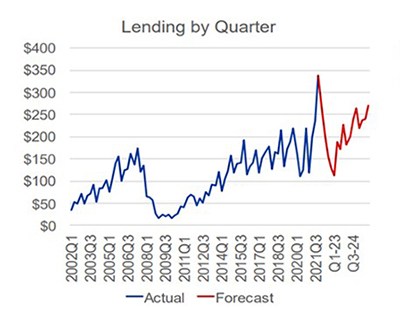

MBA Chart of the Week Jan. 6, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

MBA Chart of the Week Jan. 6, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

MBA CREF Outlook Survey: Unsettled Markets to Dissipate in 2023

Commercial and multifamily mortgage originators are experiencing an unsettled market for borrowing and lending but anticipate those conditions will slowly stabilize over the course of this year, the Mortgage Bankers Association’s 2023 Commercial Real Estate Finance Outlook Survey found.

MBA CREF Outlook Survey: Unsettled Markets to Dissipate in 2023

Commercial and multifamily mortgage originators are experiencing an unsettled market for borrowing and lending but anticipate those conditions will slowly stabilize over the course of this year, the Mortgage Bankers Association’s 2023 Commercial Real Estate Finance Outlook Survey found.

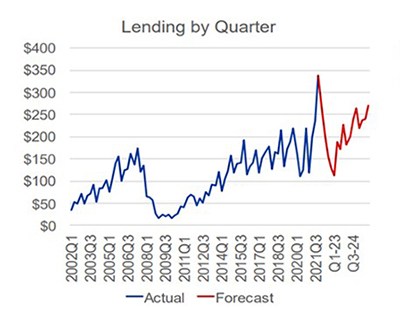

MBA: 2023 Commercial, Multifamily Borrowing/Lending Expected to Fall to $700B

The Mortgage Bankers Association released its updated baseline forecast Thursday, projecting total commercial and multifamily mortgage borrowing and lending to fall to $700 billion this year, a 5 percent decline from an expected 2022 total of $740 billion.

MBA: 2023 Commercial, Multifamily Borrowing/Lending Expected to Fall to $700B

The Mortgage Bankers Association released its updated baseline forecast Thursday, projecting total commercial and multifamily mortgage borrowing and lending to fall to $700 billion this year, a 5 percent decline from an expected 2022 total of $740 billion.

MBA: 3Q Commercial, Multifamily Mortgage Debt Outstanding Up $70B

Commercial and multifamily mortgage debt outstanding increased by $70.0 billion (1.6 percent) in the third quarter, the Mortgage Bankers Association reported Tuesday in its quarterly Commercial/Multifamily Mortgage Debt Outstanding Report.