On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

Tag: Jamie Woodwell

#CREF2020: MBA: Commercial/Multifamily Borrowing Hits New High to Close Out 2019

SAN DIEGO–A 7 percent increase in commercial and multifamily mortgage originations in the fourth quarter capped off a strong 2019 for the market, according to preliminary estimates from the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

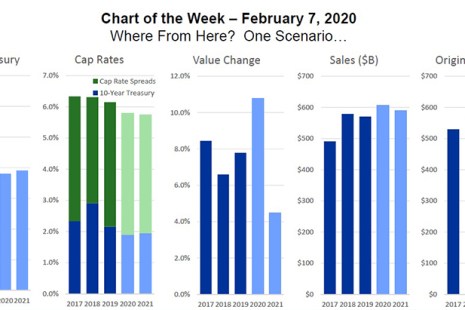

MBA Chart of the Week: Where from Here? One Scenario

On Sunday, we kicked off CREF 2020–MBA’s 2020 Commercial Real Estate Finance/Multifamily Housing Convention & Expo, with an economic and mortgage market update. One of the main messages: the commercial/multifamily markets ended 2019 on a very strong note.

MBA: Commercial/Multifamily Borrowing Hits New High to Close Out 2019

SAN DIEGO–A 7 percent increase in commercial and multifamily mortgage originations in the fourth quarter capped off a strong 2019 for the market, according to preliminary estimates from the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

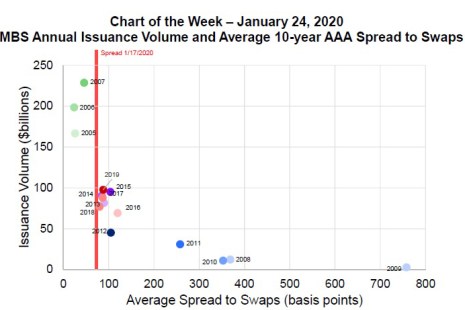

MBA Chart of the Week: CMBS Annual Issuance Volume

After a slow start in 2019, the commercial mortgage-backed securities market ended strong, with $39.1 billion of private-label CMBS issuance during the fourth quarter – more than double the $18.8 billion issued during fourth quarter 2018.

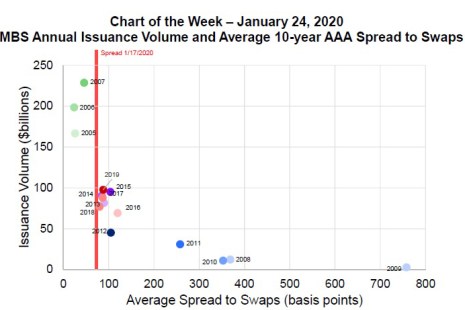

MBA Chart of the Week: CMBS Annual Issuance Volume

After a slow start in 2019, the commercial mortgage-backed securities market ended strong, with $39.1 billion of private-label CMBS issuance during the fourth quarter – more than double the $18.8 billion issued during fourth quarter 2018.

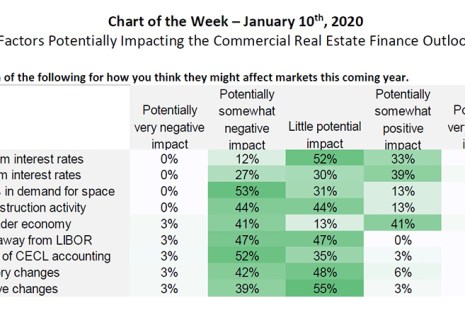

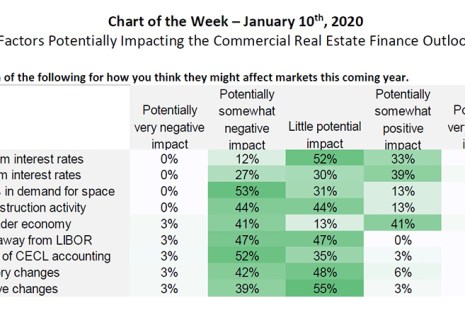

MBA Chart of the Week: Factors Impacting Commercial Real Estate Finance

Buoyed by low interest rates, strong property markets and rising property values, commercial and multifamily mortgage banking firms anticipate a solid year in 2020, according to MBA’s 2020 Commercial Real Estate Finance (CREF) Outlook Survey.

MBA Chart of the Week: Factors Impacting Commercial Real Estate Finance

Buoyed by low interest rates, strong property markets and rising property values, commercial and multifamily mortgage banking firms anticipate a solid year in 2020, according to MBA’s 2020 Commercial Real Estate Finance (CREF) Outlook Survey.

CREF Outlook Survey: Majority of Firms Expect Originations to Increase in 2020

Following an anticipated record year of lending in 2019, commercial and multifamily mortgage originators expect 2020 to be another strong year in activity, according to the Mortgage Bankers Association’s 2020 Commercial Real Estate Finance Outlook Survey.

CREF Outlook Survey: Majority of Firms Expect Originations to Increase in 2020

Following an anticipated record year of lending in 2019, commercial and multifamily mortgage originators expect 2020 to be another strong year in activity, according to the Mortgage Bankers Association’s 2020 Commercial Real Estate Finance Outlook Survey.