Commercial and multifamily mortgage loan originations decreased 2 percent in the first quarter from a year ago, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Tag: Jamie Woodwell

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

As mortgage lenders shift focus from production to portfolio management in response to COVID-19, industry shifts are occurring alongside the inevitable reallocation of lending operation resources.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

As mortgage lenders shift focus from production to portfolio management in response to COVID-19, industry shifts are occurring alongside the inevitable reallocation of lending operation resources.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy.

MBA: 2019 Commercial/Multifamily Originations Reach Record $600.6 Billion

Commercial and multifamily mortgage bankers closed a record $600.6 billion of loans in 2019, according to the Mortgage Bankers Association’s 2019 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

MBA: 2019 Commercial/Multifamily Originations Reach Record $600.6 Billion

Commercial and multifamily mortgage bankers closed a record $600.6 billion of loans in 2019, according to the Mortgage Bankers Association’s 2019 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

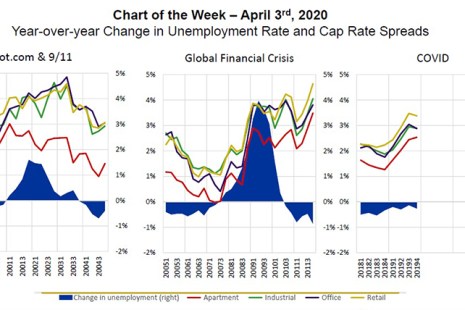

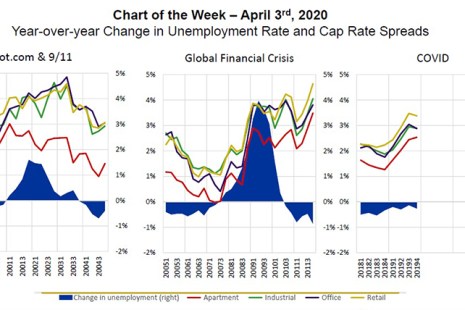

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.

CRE Finance in an Uncertain World

MBA hosted a webinar on Friday, March 27 with commercial real estate finance industry leaders to discuss COVID-19’s impacts on the industry.

CRE Finance in an Uncertain World

MBA hosted a webinar on Friday, March 27 with commercial real estate finance industry leaders to discuss COVID-19’s impacts on the industry.