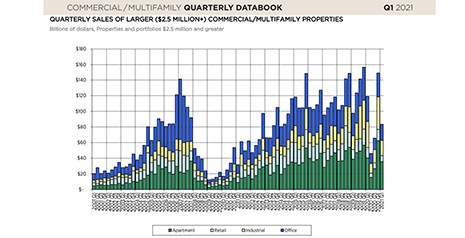

On Wednesday, the Mortgage Bankers Association released its first quarter Commercial/Multifamily DataBook.

Tag: Jamie Woodwell

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Up 1.1%

Commercial and multifamily mortgage debt outstanding rose by $44.6 billion or 1.1 percent in the first quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report said.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Up 1.1%

Commercial and multifamily mortgage debt outstanding rose by $44.6 billion or 1.1 percent in the first quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report said.

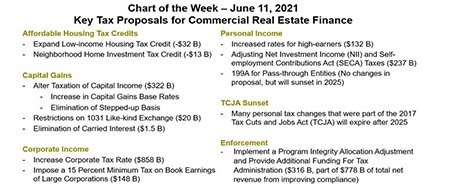

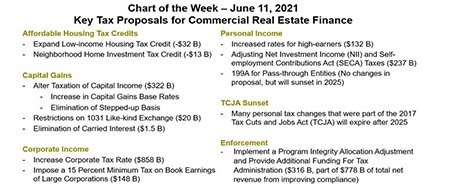

MBA Chart of the Week June 14, 2021: Key Tax Proposals for Commercial Real Estate Finance

The Biden Administration’s proposed Fiscal Year 2022 Budget put down in black and white – and dollars and cents – many suggestions that have been made in more general terms in the Administration’s American Jobs and Family Plan, during the most recent presidential campaigns and in some cases going back decades.

MBA Chart of the Week June 14, 2021: Key Tax Proposals for Commercial Real Estate Finance

The Biden Administration’s proposed Fiscal Year 2022 Budget put down in black and white – and dollars and cents – many suggestions that have been made in more general terms in the Administration’s American Jobs and Family Plan, during the most recent presidential campaigns and in some cases going back decades.

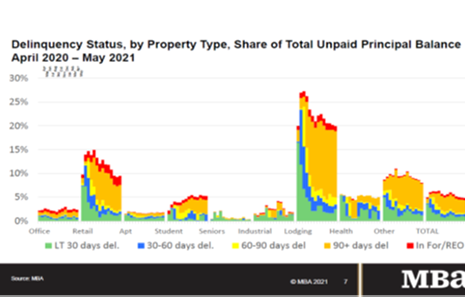

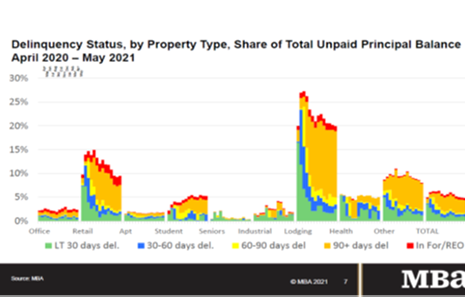

MBA: CMF Mortgage Delinquencies Decline to Lowest Level Since Pandemic

Delinquency rates for mortgages backed by commercial and multifamily properties continue to decline, according to two reports released Thursday by the Mortgage Bankers Association.

MBA: CMF Mortgage Delinquencies Decline to Lowest Level Since Pandemic

Delinquency rates for mortgages backed by commercial and multifamily properties continue to decline, according to two reports released Thursday by the Mortgage Bankers Association.

ULI: CRE ‘Poised for a Rebound’

A panel of 42 real estate economists said commercial real estate is “poised for a rebound,” the Urban Land Institute reported.

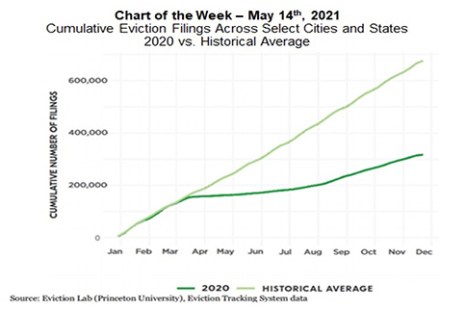

MBA Chart of the Week May 17, 2021: Cumulative Eviction Filings, 2020 v. Historical Average

On Wednesday, May 5, U.S. District Court Judge Dabney Friedrich issued an order vacating the U.S. Centers for Disease Control and Prevention’s national eviction moratorium. But with the number of Covid-19 cases, hospitalizations and deaths falling, increased attention is being paid to when, and how, to allow the various moratoriums to phase-out.

MBA: 1Q Commercial, Multifamily Borrowing Declines 14 Percent

Commercial and multifamily mortgage loan originations decreased 14 percent in the first quarter from a year ago, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.