Is the logjam in CRE transaction activity starting to break?

Tag: Jamie Woodwell

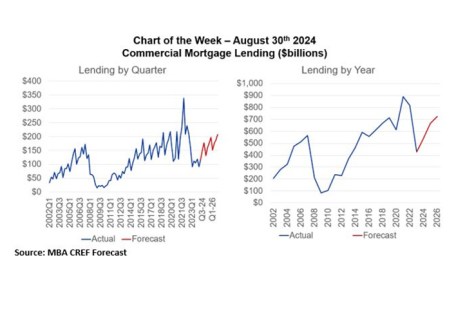

MBA Forecast: Commercial/Multifamily Borrowing and Lending to Increase 26% to $539 Billion in 2024

Total commercial and multifamily mortgage borrowing and lending is expected to finish the year at $539 billion, which is a 26% increase from 2023’s total of $429 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association.

MBA: Commercial/Multifamily Borrowing Increased 3% in the Second Quarter

Commercial and multifamily mortgage loan originations increased 3% in the second quarter compared to a year ago and increased 27% from the first quarter, according to MBA’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: Multifamily Lending Declined 49% to $246 Billion in 2023

In 2023, 2,520 different multifamily lenders provided a total of $246.2 billion in new mortgages for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual report of the multifamily lending market.

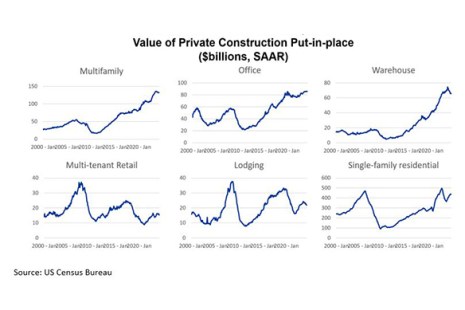

MBA Chart of the Week: Value of Private Construction Put-in-Place

Physicists have protons, neutrons, and electrons. Biologists have DNA and RNA. And economists have supply and demand — the building blocks upon which most of our understanding of markets rest.

MBA Releases Q1 2024 Commercial/Multifamily DataBook

The Mortgage Bankers Association just released its Q1 2024 Commercial/Multifamily Quarterly DataBook.

Commercial and Multifamily Mortgage Debt Outstanding Increased in First Quarter: MBA

The level of commercial/multifamily mortgage debt outstanding increased by $40.1 billion (0.9%) in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

MBA: Commercial Mortgage Delinquency Rates Increased in First Quarter

Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

Offices, Insurance Top Commercial Servicing Conversations, Panel Says

NEW ORLEANS–Looking at servicing in the current commercial market, offices and insurance issues are top of mind. That’s per a panel at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference, here, May 20.

MBA: Commercial/Multifamily Borrowing Unchanged in First Quarter

Commercial and multifamily mortgage loan originations were essentially unchanged in the first quarter compared to a year ago, and decreased 23% from the fourth quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.