Customer satisfaction with the nation’s largest banks has risen for three straight years, according to research firm J.D. Power, Troy, Mich.

Tag: J.D. Power

Mortgage Servicing Apps Deliver Uneven User Experience, J.D. Power Finds

The mortgage servicing industry lags behind other sectors when it comes to streamlined, easy-to-navigate interfaces and convenient access, according to J.D. Power, Troy, Mich.

Mortgage Customer Satisfaction Surges, J.D. Power Reports

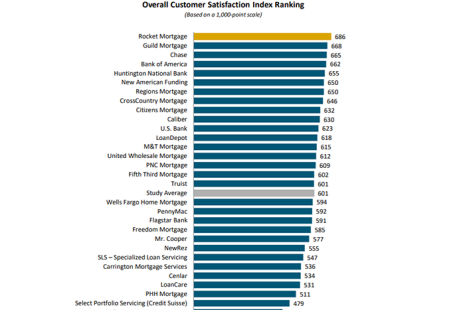

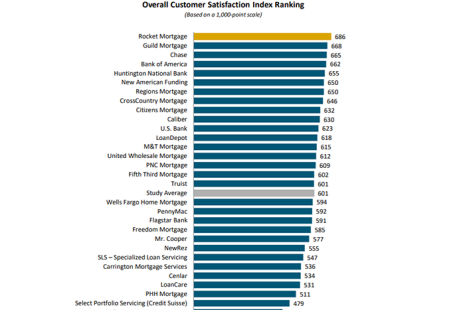

J.D. Power, Troy, Mich., says mortgage lenders are adopting a more consultative, advisory-style engagement with customers, “[and] that shift is paying off in the form of significantly higher customer satisfaction scores, improved trust and increased levels of brand loyalty.”

Mortgage Servicers Lag Originators on Customer Engagement, J.D. Power Finds

Mortgage servicers lag far behind originators on customer engagement, a new report from J.D. Power found.

Decoding Customer Satisfaction and Loyalty: Key Insights from J.D. Power’s Latest Mortgage Studies, Jan. 21

Click here for more information About the Event:This webinar examines critical findings from J.D. Power’s latest mortgage origination and servicing studies, revealing why traditional customer acquisition and retention strategies are …

Mortgage Lenders Benefit From Helping Customers Navigate Tough Housing Market, J.D. Power Finds

Persistently high rates combined with rising house prices have put a strain on mortgage customers, buts some lenders have turned those challenges into opportunity and earned high marks for customer satisfaction, according to J.D. Power, Troy, Mich.

Susan Graham from FICS: Unlocking Success–Five Vital Features of Mortgage Servicing Software

Rising interest rates and high inflation are putting a strain on mortgage holders. The 2023 J.D. Power U.S. Mortgage Servicer Satisfaction Study found a significant decline in customer satisfaction compared to the previous year. J.D. Power attributes this decline to a combination of weaker financial health, an increased rate of mortgage transfers and a rise in issues resolving account problems.

Susan Graham from FICS: Unlocking Success–Five Vital Features of Mortgage Servicing Software

Rising interest rates and high inflation are putting a strain on mortgage holders. The 2023 J.D. Power U.S. Mortgage Servicer Satisfaction Study found a significant decline in customer satisfaction compared to the previous year. J.D. Power attributes this decline to a combination of weaker financial health, an increased rate of mortgage transfers and a rise in issues resolving account problems.

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.