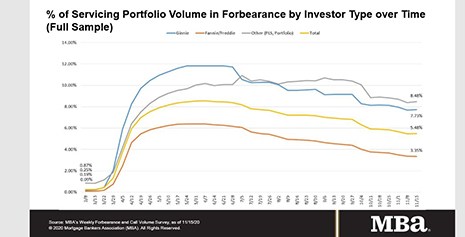

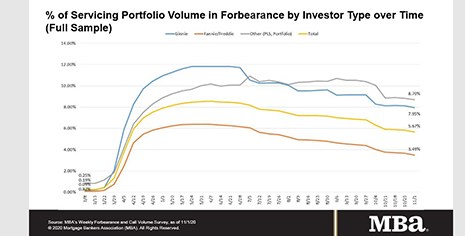

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

Tag: Independent Mortgage Banks

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

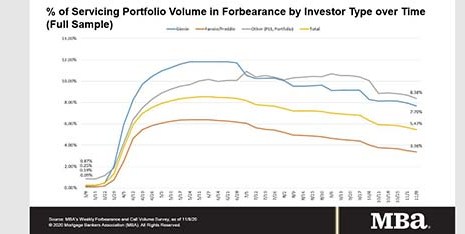

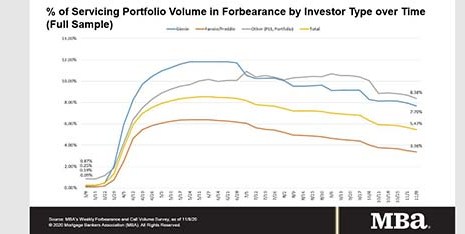

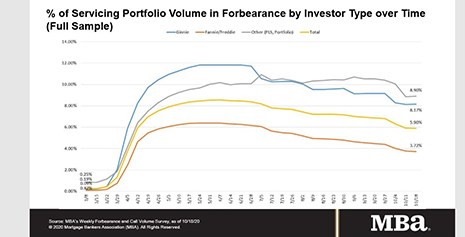

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

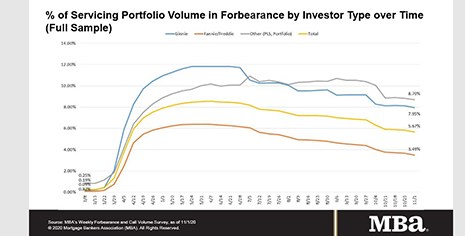

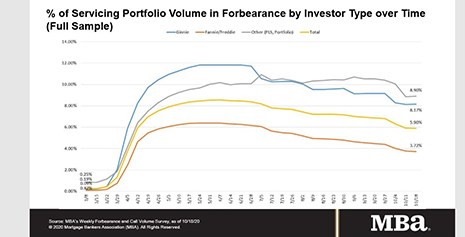

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.