Clarifire, St. Petersburg, Fla., announced its CLARIFIRE workflow automation application has gone live with Resolve, Freddie Mac’s new integrated default management platform.

Tag: ICE Mortgage Technology

Industry Briefs Oct. 20, 2021: SimpleNexus Acquires LBA Ware

SimpleNexus, Lehi, Utah, announced its acquisition of software firm LBA Ware, Macon, Ga. The transaction, SimpleNexus’ first, brings together 325 employees in 29 states to serve 425 distinct lender customers and dozens of mortgage technology integration partners.

Industry Briefs Oct. 13, 2021: Ginnie Mae Reports Record Fiscal Year MBS Issuance

Ginnie Mae, Washington, D.C., reported mortgage-backed securities issuance volume for fiscal year 2021 grew to a record $939 billion, with issuance for September coming in at $73 billion.

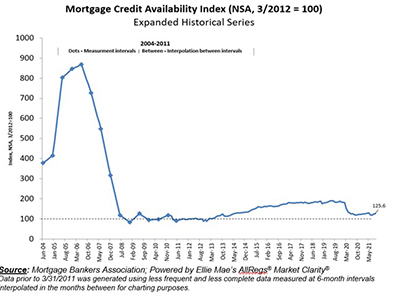

September Mortgage Credit Availability Up 1.5%

Mortgage credit availability increased for the third straight month in September to its highest level in five months, the Mortgage Bankers Association reported Tuesday.

Industry Briefs Sept. 24, 2021: CFPB Says Renters at Risk as COVID Safety Net Ends

The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

Industry Briefs Sept. 16, 2021: Covius Acquires Nationwide Title Clearing

Covius Holdings Inc., Denver, a provider of technology-enabled platforms to the financial services industry, reached an agreement to acquire Palm Harbor, Fla.-based Nationwide Title Clearing Inc., a national lien release provider.

Industry Briefs Aug. 27, 2021: Home Lending Pal Raises $2M

The Mortgage Collaborative, San Diego, announced the TMC Emerging Technology Fund LP led a pre-Series A investment round in Home Lending Pal, a technology-enabled marketplace that focuses on fair lending practices.

Industry Briefs Aug. 23, 2021

Fannie Mae, Washington, D.C., revised its full-year 2021 real GDP growth forecast modestly downward due in part to the expectation that COVID-related disruptions to consumer spending and supply chains will more greatly hinder economic activity in the second half of the year than previously forecast.

ICE: Purchases Eclipse Refinances for First Time in 18 Months

ICE Mortgage Technology, Pleasanton, Calif., reported new home purchases represented a higher percentage than refinances for the first time in nearly two years.

Millennial Homeownership Increases as Credit Loosens

ICE Mortgage Technology, Pleasanton, Calif., said the number of purchase loans closed by millennials in May jumped to 67%; for younger millennials, the percentage was even higher (82%).