Industry news from MeridianLink, Proof, Click n’ Close, Blue Sage Solutions, Pennymac, Friday Harbor and ICE Mortgage Technology.

Tag: ICE Mortgage Technology

ICE Mortgage Monitor: Property Insurance Costs Continue to Grow

ICE Mortgage Technology, Atlanta, released its ICE Mortgage Monitor Report, highlighting a continued surge in property insurance costs.

Industry Briefs, Sept. 9, 2025

Industry news from MeridianLink, Proof, Click n’ Close, Blue Sage Solutions, Pennymac, Friday Harbor and ICE Mortgage Technology.

ICE First Look: Delinquencies Ease in July; Foreclosure Activity Edges Higher

U.S. mortgage performance remains remarkably strong compared to pre-pandemic norms, marked by delinquencies declining on an annual basis, according to ICE Mortgage Technology, Atlanta.

Mortgage Industry Veteran John Hedlund Nominated to Be 2026 MBA Vice Chairman

MBA announced that John Hedlund, a decades-long MBA and industry leader and current Vice Chairman of ICE Mortgage Technology, has been nominated to serve as MBA’s Vice Chairman for the 2026 membership year.

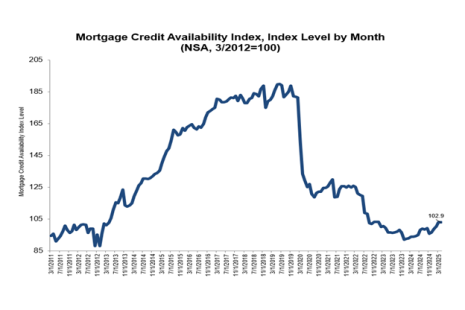

Mortgage Credit Availability Decreased in June

Mortgage credit availability decreased in June according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

ICE Mortgage Monitor: Record Levels of Home Equity, Falling Rates Drive Highest HELOC Withdraws Since 2008

U.S. mortgage holders carried a record $17.6 trillion in home equity entering the second quarter–with $11.5 trillion considered “tappable”–according to ICE Mortgage Technology, Atlanta.

Industry Briefs, May 23, 2025

Industry news from Freddie Mac, Cloudvirga, Informative Research, Halcyon, BOK Financial, ServiceLink, Argyle and ICE Mortgage Technology.

Industry Briefs, May 22, 2025

Industry news from Freddie Mac, Cloudvirga, Informative Research, Halcyon, BOK Financial, ServiceLink, Argyle and ICE Mortgage Technology.

Mortgage Credit Availability Unchanged in April

Mortgage credit availability remained unchanged in April according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.