This morning’s Monday Report features stories that confirm the housing markets remain hot, regardless of location or political preference; what that might mean for down payments; and a housing survey that, thanks to the coronavirus pandemic, was obsolete the moment it was released.

Tag: HUD

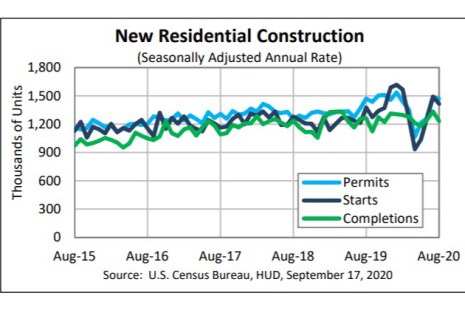

After Strong Summer, August Housing Starts Underwhelm

Housing starts—one of the bright spots in a red-hot summer housing market—faltered in August, HUD and the Census Bureau reported yesterday, although most of the decline took place in multifamily.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD yesterday announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

July New Home Sales Hit 13-Year High

Sales of new single-family houses in July posted another strong double-digit gain, jumping to their strongest pace since 2006, HUD and the Census Bureau reported yesterday.

Industry Briefs Aug. 19, 2020

Freedom Mortgage Corp., Mount Laurel, N.J., and RoundPoint Mortgage Servicing Corp., Charlotte, N.C. completed their previously announced merger. RoundPoint is now a wholly owned subsidiary of Freedom Mortgage, a full-service mortgage company and provider of VA and government-insured lending.

With Wind at Its Back, Housing Starts Continue Summer Surge

Housing starts posted double-digit increases for the second straight month, HUD and the Census Bureau reported yesterday, to its highest level since February.

Record Traffic Spurs Home Builder Index to New High

It’s been quite a year for the National Association of Home Builders/Wells Fargo Housing Market Index. In April, amid the worst of the coronavirus pandemic, the Index plunged 30 points to its lowest level since 2012. Yesterday—just four months later—the Index reached its highest point in its 35-year history.

Nineteen Associations Ask FHA To Revise Borrowers’ Student Loan Debt Treatment

The Mortgage Bankers Association and 18 other groups asked the Federal Housing Administration to revise its treatment of borrowers’ student loan debt to better align with the standards at the GSEs, VA and USDA.

Senate Confirms Dana Wade as FHA Commissioner

he Senate yesterday confirmed Dana Wade as FHA Commissioner by a 57-40 vote. The Mortgage Bankers Association strongly supported Wade’s nomination.

New Home Sales Post 2nd Consecutive Strong Monthly Increase

New home sales beat expectations again in June, HUD and the Census Bureau reported Friday, posting double-digit increases for the second straight month.