On Tuesday, the House voted to adopt a $3.5 trillion budget resolution framework for Fiscal Year 2022. Also on Tuesday, MBA submitted a joint coalition letter to HUD on its disparate impact rule.

Tag: HUD

MBA, Trade Groups Ask HUD for ‘Consistent’ Re-Codification of Disparate Impact Proposed Rule

The Mortgage Bankers Association, the American Bankers Association, the Consumer Bankers Association and the Independent Community Bankers of America asked HUD to ensure it codifies a standard of disparate impact that is fully consistent with Supreme Court precedent and implements the Fair Housing Act’s requirements with a clear legal framework to address unlawful discrimination.

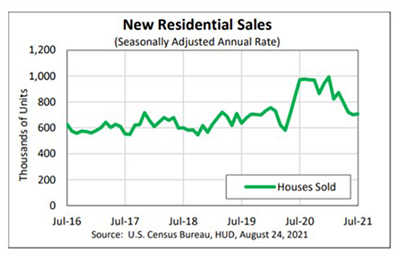

July New Home Sales Post 1% Increase

New single‐family home sales posted a modest 1 percent increase in July amid more signs of a stabilizing housing market, HUD and the Census Bureau reported Tuesday.

Industry Briefs Aug. 17, 2021

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

FHFA, FHA Extend Single-Family Eviction Moratoria through Sept. 30

The Federal Housing Finance Agency and the Federal Housing Administration on Friday extended their eviction moratoria through Sept. 30 for foreclosed borrowers and other occupants.

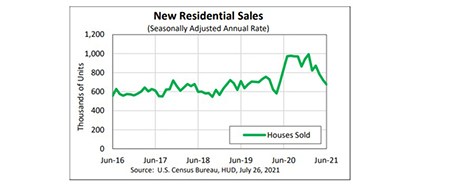

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.

Industry Briefs July 29, 2021

NotaryCam, Newport Beach, Calif., partnered with RUTH RUHL P.C., a Texas-based law firm, to add security and automation to the firm’s loss mitigation services through remote online notarization.

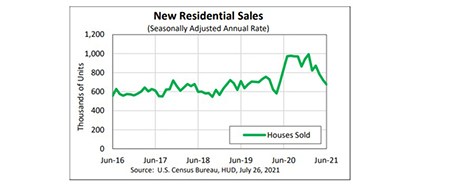

June New Home Sales Down 6.6%

June new home sales fell well below consensus expectations, HUD and the Census Bureau reported Monday, though analysts did not appear to be too worried by the results.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.