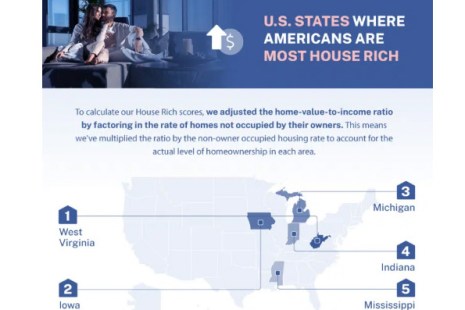

All Star Home, Raleigh, N.C., sought to figure out what state is the most “house rich,” a status it defined as homeownership being dominant and homes being relatively affordable compared to the local median income. Per its analysis, West Virginia took the top spot.

Tag: Homeownership

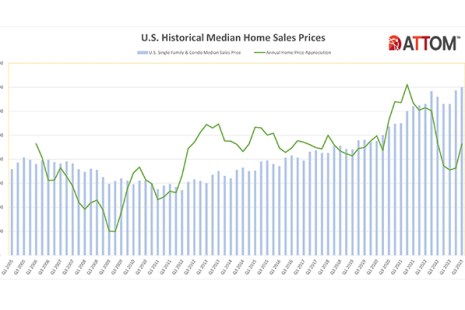

ATTOM Finds Profit Margins, Homeownership Tenure, Cash Sales Up

ATTOM, Irvine, Calif., released its third-quarter 2023 U.S. Home Sales Report, showing profit margins on median-priced homes are up from the second quarter, along with other metrics such as homeownership tenure and cash sales.

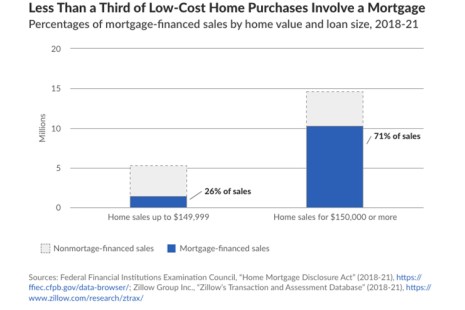

Small Mortgages Lacking, Pew Says

The Pew Charitable Trusts, Philadelphia, found small mortgages to purchase low-cost homes–defined as those priced below $150,000–have become increasingly scarce.

Higher Rates Make Renting More Affordable that Homeownership

ATTOM, Irvine, Calif., said higher mortgage interest rates tipped the needle toward renting over homeownership.

Jim Paolino of Lodestar: By the Numbers–Did Increased WFH Opportunities Help Spur Home Buying in Metro Suburbs?

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.

Jim Paolino of Lodestar: By the Numbers–Did Increased WFH Opportunities Help Spur Home Buying in Metro Suburbs?

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.

Faith Schwartz of Housing Finance Strategies: Homeownership Month Focus on Policy Innovation to Up-Level the FTHB

The trend we address in this short narrative is the shrinking playing field for first-time homebuyers who are more and more being shut out of buying opportunities by institutional cash buyers and losing the attendant opportunity for the creation of generational wealth.

Faith Schwartz of Housing Finance Strategies: Homeownership Month Focus on Policy Innovation to Up-Level the FTHB

The trend we address in this short narrative is the shrinking playing field for first-time homebuyers who are more and more being shut out of buying opportunities by institutional cash buyers and losing the attendant opportunity for the creation of generational wealth.

Faith Schwartz of Housing Finance Strategies: Homeownership Month Focus on Policy Innovation to Up-Level the FTHB

The trend we address in this short narrative is the shrinking playing field for first-time homebuyers who are more and more being shut out of buying opportunities by institutional cash buyers and losing the attendant opportunity for the creation of generational wealth.

Faith Schwartz of Housing Finance Strategies: Homeownership Month Focus on Policy Innovation to Up-Level the FTHB

The trend we address in this short narrative is the shrinking playing field for first-time homebuyers who are more and more being shut out of buying opportunities by institutional cash buyers and losing the attendant opportunity for the creation of generational wealth.