Our industry has come up with plenty of applications for AI, but they can still go a step further toward what the future of AI in mortgage actually looks like. That future is Content Intelligence.

Tag: HMDA

Your HMDA Data Is Telling You More Than You Think: A Practical Path to Profitable, Inclusive Purchase Growth

iEmergent’s Laird Nossuli and Down Payment Resource’s Rob Chrane write that while HMDA data is often viewed through a compliance lens, it also offers a clear, retrospective view of where affordability breaks down.

Chart of the Week: 2024 HMDA Respondents

A total of 4,758 companies reported lending activity under the Home Mortgage Disclosure Act in 2024, according to MBA’s analyses of the dataset.

Inside the 2024 HMDA Data: Growth, Gaps, and a Shifting Landscape

iEmergent CEO Laird Nossuli says the latest HMDA data indicate early recovery and shifting dynamics, with independent mortgage banks gaining ground and refinancing activity returning.

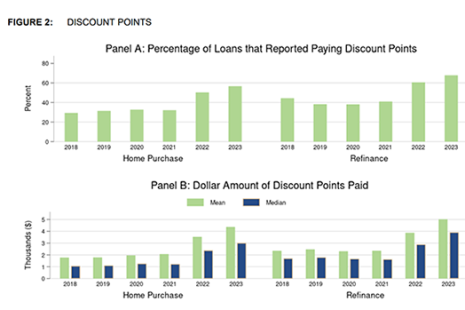

CFPB Reports Significant Drop in Mortgage Applications, Originations in 2023

The Consumer Financial Protection Bureau, Washington, D.C., found a significant decline in mortgage lending activities during 2023. Loan applications and originations dropped by nearly one-third from 2022.

Are You One of the 13? Jason Wilborn from Accenture Credit Services

Only 13 lenders out of all 4464 from 2022 grew or maintained their origination volumes from 2022 to 2023.

Are You One of 13? Accenture Credit Services’ Jason Wilborn

Only 13 lenders out of all 4464 from 2022 grew or maintained their origination volumes from 2022 to 2023.

Accenture Credit Services’ Jason Wilborn: Are You One of 13?

Only 13 lenders out of all 4464 from 2022 grew or maintained their origination volumes from 2022 to 2023.

MBA Chart of the Week: Share of Originations by Production Channel

The broker wholesale and non-delegated correspondent production channels accounted for a combined 20.5 percent of dollar volume originated in 2023 per MBA’s analyses of the Home Mortgage Disclosure Act (HMDA) data.

MBA Chart of the Week: 2023 HMDA Respondents

A total of 4,874 companies reported lending activity under the Home Mortgage Disclosure Act (HMDA) in 2023, according to MBA’s analyses of the dataset.