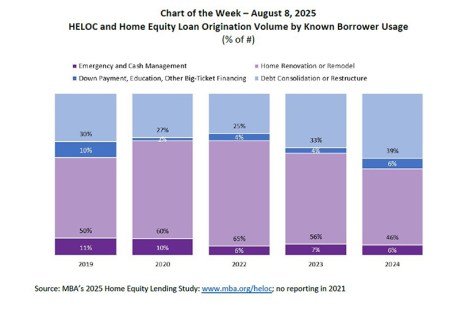

MBA recently completed its 2025 Home Equity Lending Study, tracking trends in origination and servicing for home equity lines of credit (HELOCs) and home equity loans.

Tag: HELOC

Nearly 30% of Homeowners Considering Home Equity Loans, MeridianLink Finds

Nearly three in 10 American homeowners are considering taking out a home equity loan or HELOC in the next 12 months, according to a new survey from MeridianLink, Costa Mesa, Calif.

MISMO Creates Standard for Electronic HELOCs

MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comment on the SMART Doc V3 eHELOC Specification.

MBA: Home Equity Lending Volume Stays Relatively Flat in 2023; Debt Outstanding Increases

Total originations of open-ended Home Equity Lines of Credit (HELOCs) and closed-end home equity loans increased in 2023 by 1.5% compared to the previous year, while debt outstandings increased 8.3%.

When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key–Anna Krogh From Dovenmuehle

While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Dovenmuehle’s Anna Krogh: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Anna Krogh From Dovenmuehle: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Tavant’s Hassan Rashid on Unlocking Home Equity: A Strategic Move for 2024

As we make strides into 2024, American homeowners find themselves amidst an intriguing landscape of financial opportunities, particularly concerning the utilization of home equity.

TD Bank Survey: Homeowners Plan to Tap Into Equity for Renovations

TD Bank, Cherry Hill, N.J., released its HELOC Trend Watch survey, finding that 38% of homeowners who are renovating their properties within the next two years intend to use a home equity line of credit or home equity loan for funds.

Tavant’s Shannon Johnson on Rethinking HELOCs: Embracing Innovation in the Evolving Mortgage Industry

The mortgage industry has witnessed significant changes in recent years, challenging lenders and servicers to adapt to new market dynamics. As interest rates shifted, offering unique opportunities and posing new challenges, the home equity line of credit has emerged as a thought-provoking tool in the mortgage space.