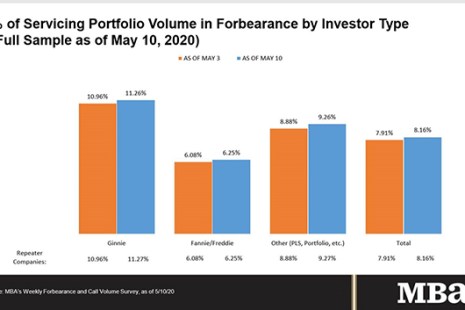

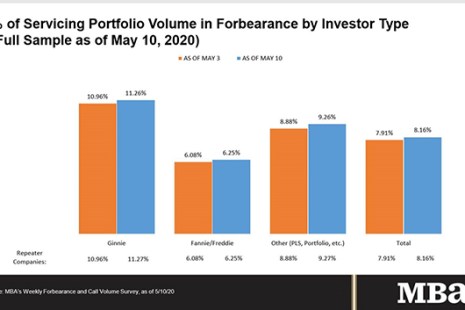

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

Tag: Ginnie Mae

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

Industry Briefs

Essent Guaranty Inc., Radnor, Pa., and Cloudvirga, Irvine, Calif., announced an integration in which Cloudvirga will offer Essent’s products and services.

Industry Briefs

Ginnie Mae, Washington, D.C., issued All Participants Memorandum 20-05 (APM 20-05), announcing expansion of its Issuer assistance programs in response to the coronavirus pandemic.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

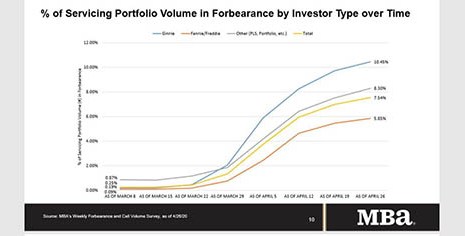

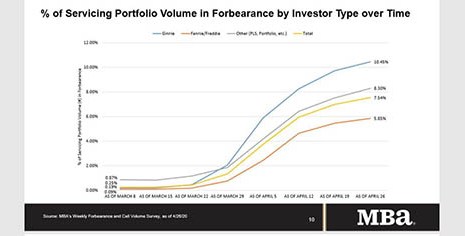

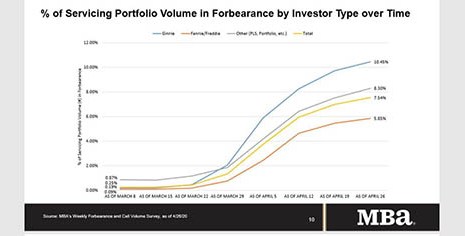

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.80 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed the number of loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, a total of 3.80 million homeowners are now in forbearance plans.

Ginnie Mae Begins Publishing PTAP/C19 Data

Ginnie Mae, Washington, D.C., on May 1 published the first set of data related to its expanded Pass-Through Assistance Program (PTAP/C19), developed in response to the COVID-19 pandemic.

Mortgage Action Alliance ‘Call to Action’ Urges Congress to Act on Liquidity Facility

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a ‘Call to Action’ on Friday, urging its members to contact their members of Congress to support legislation that would provide lenders and servicers with liquidity support.