Verus Commercial Real Estate Finance, New York, launched a new product for financing of Single-Family Home Rental Portfolios.

Tag: Ginnie Mae

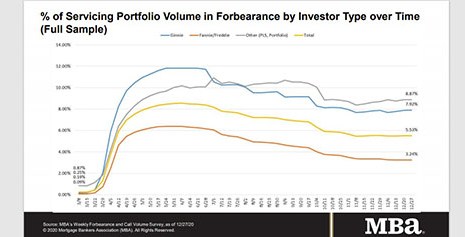

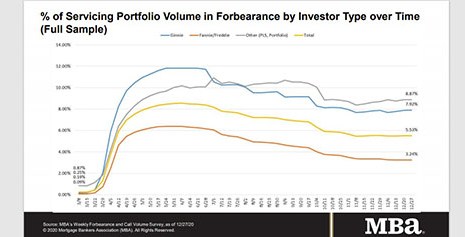

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

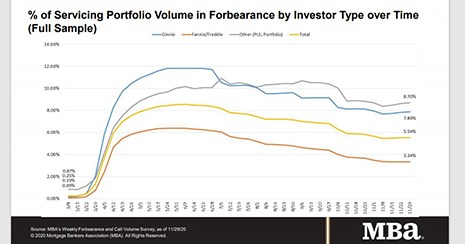

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

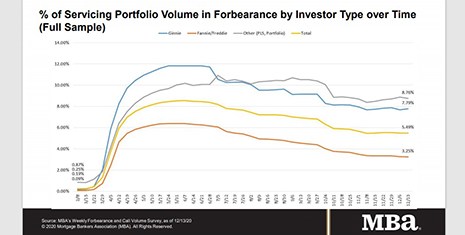

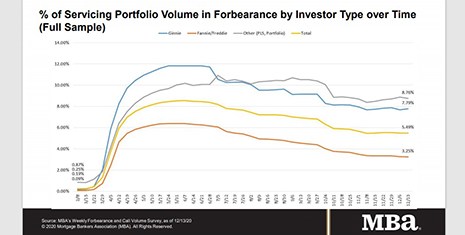

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

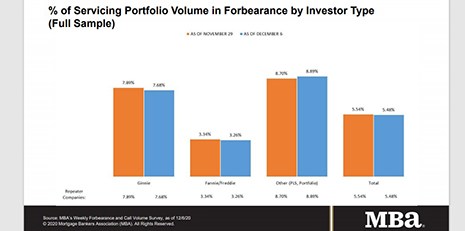

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Industry Briefs Dec. 15, 2020

LERETA, Pomona, Calif., a provider of national real estate tax and flood services, acquired the Flood Determinations Solution from Wolters Kluwer Governance, Risk & Compliance, Minneapolis, for an undisclosed sum.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.