Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

Tag: Freddie Mac

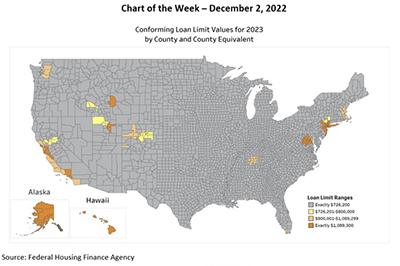

MBA Chart of the Week Dec. 2, 2022: GSE Conforming Loan Limits

Last week, the Federal Housing Finance Agency announced conforming loan limits for mortgages eligible to be acquired by Fannie Mae and Freddie Mac in 2023. The 2023 loan limit for one-unit properties for most of the country will be $726,200, an increase of $79,000 from $647,200 in 2022.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

FHFA Raises 2023 GSE Conforming Loan Limits to $726,000

The Federal Housing Finance Agency on Tuesday increased the conforming loan limit values for mortgages to be acquired by Fannie Mae and Freddie Mac for one-unit properties to $726,200, an increase of 12.21 percent ($79,000) from $647,200 in 2022.

Industry Briefs Oct. 25, 2022: NewDay USA to West Palm Beach?

NewDay USA, Fulton, Md., is expanding and taking occupancy with 250 employees in the top two floors of 360 Rosemary, a 20-story, 297,000-square-foot office building in West Palm Beach, Fla.. In addition, the company is in negotiations with Related Co. to relocate its Maryland-based headquarters to West Palm Beach.

Dealmaker: Harbor Group International Acquires Phoenix Multifamily Property

Harbor Group International, Norfolk, Va., acquired Colter Park Apartments in Phoenix for $80.75 million.

Industry Briefs Oct. 20, 2022: Equifax Delivers Telecomm, Utility Data in Mortgage Credit Reports

Equifax, Atlanta, said it will provide telecommunications (telco), pay TV and utilities attributes to the mortgage industry to help streamline the mortgage underwriting process and support loans within the secondary mortgage market.

MBA Urges FHFA to Embrace Standards-Based Technology Approaches to Fintech

The Mortgage Bankers Association, in a letter last week to the Federal Housing Finance Agency, said the Agency should not inadvertently hinder innovation through choices made by its regulated entities.

MBA Commends FHFA’s New Enterprise Housing Goals Methodology Proposal

The Mortgage Bankers Association on Thursday commended the Federal Housing Finance Agency for its proposed rule establishing 2023-2024 Multifamily Enterprise Housing Goals for Fannie Mae and Freddie Mac.

MISMO Seeks Public Comment on FIPS Code Lending Limit API Specification

MISMO®, the real estate finance industry standards organization, seeks public comment on a new FIPS Code Lending Limit API Specification, which will illustrate how to define a standard REST-based OpenAPI for searching lending limits based on a property’s postal code and county name.