Fannie Mae and Freddie Mac issued temporary guidance regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

Tag: Freddie Mac

Fannie Mae, Freddie Mac Issue Request for Proposals to Hire Financial Advisor

Fannie Mae, Washington, D.C., and Freddie Mac, McLean, Va., announced yesterday they will issue requests for proposals to hire an underwriting financial advisor to assist in developing and implementing a plan for recapitalizing and “responsibly ending” their conservatorship.

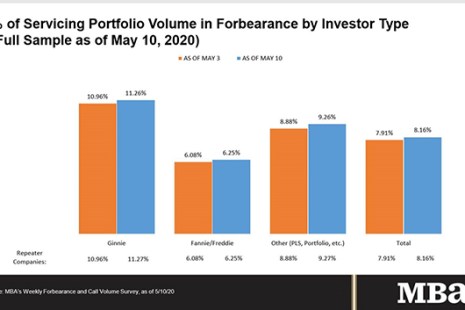

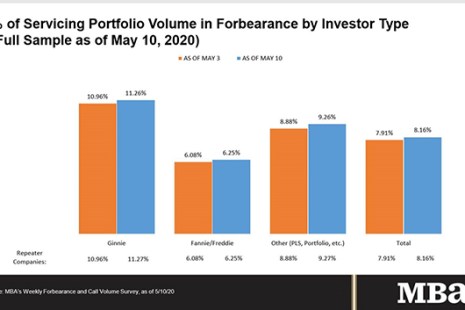

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

MBA: Share of Mortgage Loans in Forbearance Increases to 8.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed mortgage loans now in forbearance increased to 8.16% of servicers’ portfolio volume in as of May 10, up from 7.91% the previous week.

Dealmaker: Electra Capital Provides $10M in Equity Investments

Electra Capital, Lake Park, Fla., closed nearly $10 million in preferred equity investments for two Texas multifamily communities. In College Station, Electra made a $4 million, 36-month preferred equity investment …

Dealmaker: Greystone Provides $142M for Multifamily

Greystone, New York, provided $141.7 million in Fannie Mae and Freddie Mac funds for multifamily properties in Pennsylvania and New York.

FHFA, FHA Extend Foreclosure/Eviction Moratorium to June 30

The Federal Housing Finance Agency said yesterday it would extend its moratorium for Fannie Mae- and Freddie Mac-based single-family mortgages until at least June 30.

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency yesterday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency yesterday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

Scott Roller: Remote Online Notarization – Navigating the Icebergs

Necessity is the mother of all invention, so the saying goes. No, not exactly true here. RON was already being deployed in pockets across the industry pre-coronavirus. Therefore, its more appropriate to proclaim, “perplexing problems produce instant popularity where past procrastination persisted.” Said more plainly – nothing is more white-hot than RON right now, and everyone suddenly cannot live without it. Demand far-outstrips supply by a factor too large to contemplate.