The Federal Housing Finance Agency yesterday authorized Fannie Mae and Freddie Mac to impose an “Adverse Market Refinance Fee”—a 50 basis-point fee on most refinance mortgages, effective Sept. 1. The after-hours announcements drew a strong rebuke from the Mortgage Bankers Association.

Tag: Freddie Mac

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

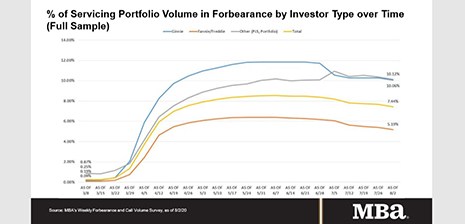

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

MBA Asks CFPB to Extend GSE ‘Patch’ Sunset

The Mortgage Bankers Association, in a comment letter yesterday to the Consumer Financial Protection Bureau, asked the Bureau to extend the temporary GSE Qualified Mortgage loan definition, also known as the GSE “Patch,” for an additional six months following the effective date for the revised general QM parameters.

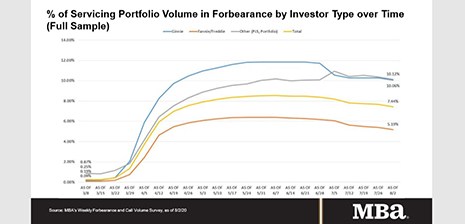

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

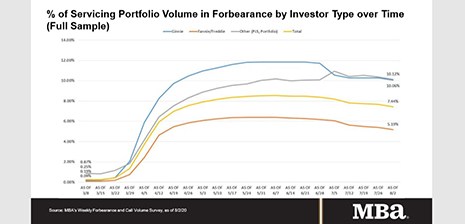

MBA: Share of Mortgage Loans in Forbearance Decreases for 8th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 23 basis points to 7.44% of mortgage servicers’ portfolio volume as of Aug. 2, down from 7.67% of servicers’ portfolio volume the prior week. MBA estimates 3.7 million homeowners are in forbearance plans.

Industry Briefs Aug. 11, 2020

Ginnie Mae, Washington, D.C., said issuance of its mortgage-backed securities totaled an agency record of $70.04 billion in July, providing financing for more than 261,000 homeowners and renters.

Dealmaker: JLL Closes $64M in Office, Multifamily Transactions

JLL, Chicago, closed $63.8 million in office and apartment property transactions in Minnesota and Colorado.

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

FHFA Extends Temporary Policy Allowing Purchase of Qualified Loans in Forbearance to Aug. 31

The Federal Housing Finance Agency approved an extension of the temporary policy that allows for the purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria set by Fannie Mae and Freddie Mac. The policy is extended for loans originated through August 31.