FormFree, Athens, Ga., partnered with ICE Mortgage Technology, part of Intercontinental Exchange Inc., a provider of data, technology and market infrastructure, to make its AccountChek 3n1 asset, income and employment verification service available in the Encompass cloud-based loan origination platform

Tag: Freddie Mac

MBA Asks FHFA for Clarity on GSE Short-Term Rental Policies

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

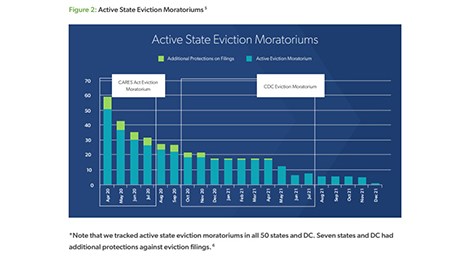

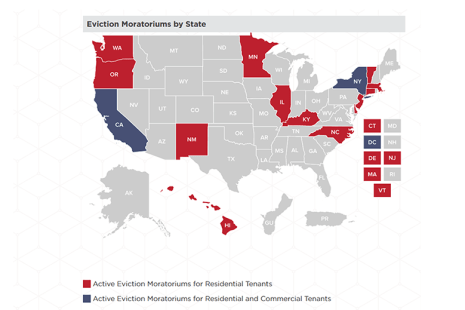

Freddie Mac: Moratoria Staved Off Eviction Crisis During Pandemic

Freddie Mac, McLean Va., said federal and local moratoria in response to the COVID-19 pandemic largely prevented an eviction crisis involving property renters—but the amount of back rent still owed is a “concerning factor” going forward.

CDC Extends National Residential Eviction Moratorium for Final Time to July 31

The Centers for Disease Control and Prevention on Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

Supreme Court Rules FHFA Director ‘Removable at Will;’ Calabria Out

The Supreme Court on Wednesday ruled that the structure of the Federal Housing Finance Agency is unconstitutional, allowing the President to remove its director at will. Shortly after the ruling, The Biden Administration removed Mark Calabria as FHFA Director.

Briefs From Arbor, Freddie Mac, Savills

Arbor Realty Trust, Uniondale, N.Y., closed an $815 million commercial real estate mortgage loan securitization.

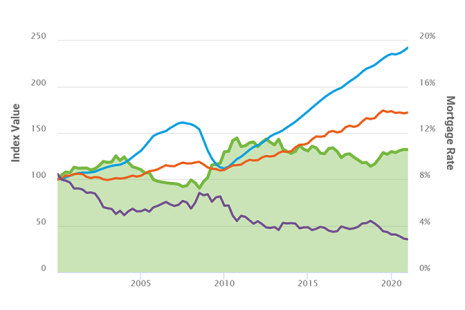

Apartment Investment Environment Stays Steady

Freddie Mac, McLean, Va., said its Apartment Investment Market Index held steady in the first quarter as continuing low interest rates support the sector.

FHFA, GSEs Extend COVID-19 Multifamily Forbearance through Sept. 30

The Federal Housing Finance Agency on Thursday said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through September 30.

Industry Briefs May 21, 2021

Quicken Loans, Detroit, announced it will officially change its name to Rocket Mortgage on July 31. This change will bring alignment to the overall “Rocket” brand.

FHFA Announces GSEs’ Proposed Duty to Serve Underserved Markets Plans for 2022-2024

The Federal Housing Finance Agency published proposed 2022-2024 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac under the Duty to Serve program. The proposed Plans cover the period from January 1, 2022 to December 31, 2024.