Merchants Capital, Carmel, Ill., secured $110 million in financing for Parkside 8 and Parkside 10, two mixed-use workforce housing developments in Washington, D.C.

Tag: Freddie Mac

CREF22: ESG, CRE and Green Lending

SAN DIEGO — As climate change intensifies, investors, owners and lenders increasingly demand environmental, social and governance reporting, panelists said here at the Mortgage Bankers Association’s 2022 Commercial/Multifamily Finance Convention and Expo.

Industry Briefs Feb. 18, 2022: Constellation Mortgage Solutions Acquires ReverseVision

Constellation Mortgage Solutions Inc., Southfield, Mich., acquired ReverseVision Inc., San Diego, a provider of Home Equity Conversion Mortgage and private reverse mortgage sales origination software.

Multifamily Starts 2022 Strong

The multifamily market saw solid rent gains in January–normally a tepid month for rent growth, reported Yardi Matrix, Santa Barbara, Calif.

Industry Briefs Feb. 10, 2022: Insellerate Gets Capital Investment

Insellerate, Newport Beach, Calif., a provider of customer relationship management and marketing automation platforms to the mortgage lender and real estate industries, announced a strategic investment led by Argentum with participation from First Analysis.

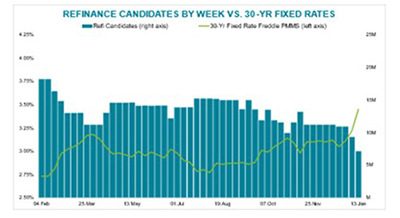

Black Knight: Rising Rates Push Refi Candidates Down to 7.1M

Black Knight, Jacksonville, Fla., said rapidly rising mortgage interest rates have shrunk the number of “high-quality” refinance candidate households to just 7.1 million, the lowest total since November 2019.

Industry Briefs Jan. 18, 2022: First American Acquires Mother Lode Holding Co.

First American Financial Corp., Santa Ana, Calif., signed an agreement for its acquisition of Mother Lode Holding Co., a California-based provider of title insurance, underwriting and escrow services for residential and commercial real estate transactions with 17 operating subsidiaries throughout the U.S., including its principal subsidiary Placer Title Co.

Industry Briefs Jan.12, 2022: nCino Completes Acquisition of SimpleNexus

nCino Inc., Wilmington, N.C., completed its acquisition of SimpleNexus, a cloud-based, mobile-first homeownership software company, for total consideration of 12.76 million shares of nCino common stock plus cash consideration of $270 million, on a cash-free, debt-free basis and excluding transaction expenses.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.