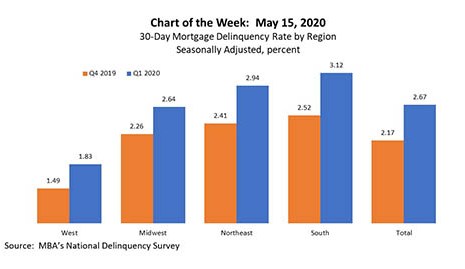

MBA released its latest National Delinquency Survey for first quarter 2020 earlier this week. At the end of the first quarter, the delinquency rate for mortgage loans on one-to-four-unit residential properties jumped by 59 basis points to a seasonally adjusted rate of 4.36 percent of all loans outstanding.

Tag: Forbearance

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

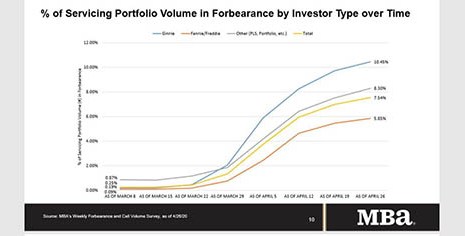

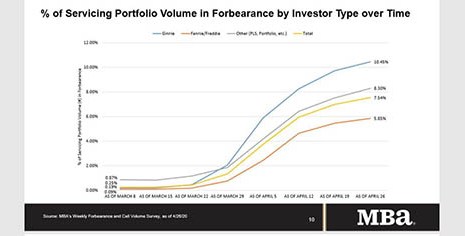

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.8 million homeowners are now in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, 3.80 million homeowners are now in forbearance plans.

MBA Launches Consumer Ad Campaign

The Mortgage Bankers Association launched a digital advertising campaign designed to help consumers facing financial challenges as a result of the COVID-19 pandemic and show how the mortgage industry is helping consumers through the coronavirus pandemic.

MBA Launches Consumer Ad Campaign

The Mortgage Bankers Association this week launched a digital advertising campaign designed to help consumers facing financial challenges as a result of the COVID-19 pandemic and show how the mortgage industry is helping consumers through the coronavirus pandemic.

To the Point with Bob: Repayment Options Are Crucial to Forbearance Strategy

In his latest blog, Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, discusses the importance of repayment options as lenders and consumers work together on forbearance strategies.

House Democrats Add Pressure to Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter yesterday to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: GSEs Will Purchase Qualified Loans in Forbearance

The Federal Housing Finance Agency said it would approve purchase of certain single-family mortgages in forbearance that meet specific eligibility criteria by Fannie Mae and Freddie Mac.

FHFA: Fannie Mae, Freddie Mac to Use 4-Month Advance Limit for Loans in Forbearance

The Federal Housing Finance Agency yesterday said it aligned Fannie Mae and Freddie Mac policies regarding servicer obligations to advance scheduled monthly principal and interest payments for single-family mortgage loans.