Fitch Ratings, New York, said the Russia/Ukraine conflict, intensified inflationary pressures and a more aggressive interest rate schema could result in more adverse outlooks for much of the global economy.

Tag: Fitch Ratings

Fitch: Slowing Trend in CMBS Defeasance

Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

Industry Briefs Feb. 18, 2022: Constellation Mortgage Solutions Acquires ReverseVision

Constellation Mortgage Solutions Inc., Southfield, Mich., acquired ReverseVision Inc., San Diego, a provider of Home Equity Conversion Mortgage and private reverse mortgage sales origination software.

Industry Briefs Feb. 10, 2022: Insellerate Gets Capital Investment

Insellerate, Newport Beach, Calif., a provider of customer relationship management and marketing automation platforms to the mortgage lender and real estate industries, announced a strategic investment led by Argentum with participation from First Analysis.

Fitch: Non-Bank Mortgage Servicers Face Increasing Regulatory Scrutiny

Fitch Ratings, New York, said regulatory scrutiny of servicing practices at U.S. mortgage companies is expected to increase in 2022 as pandemic-related government forbearance programs expire and borrowers transition into other permanent loss mitigation alternatives or default.

Industry Briefs Feb. 4, 2022: RMBS Non-Prime Mods Surge as Forbearances Expire

Fitch Ratings, New York, said non-prime loan modifications surged as forbearance plans expire across the sector.

Fitch: Some REITs Struggle with Coronavirus Effects

Fitch Ratings, New York, reported 17 percent of U.S. equity real estate investment trusts had negative outlooks in December, down significantly from a year ago.

Omicron Wave Weakens Hotel Revenue Recovery

Fitch Ratings, New York, said the global spread of the Omicron variant and new travel restrictions weaken the recovery prospects for hotel revenue per available room.

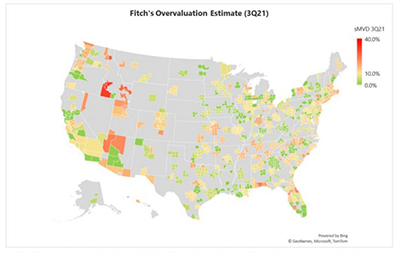

Home Price Appreciation Marches On, Unabated

Reports from Fitch Ratings, New York, and Redfin, Seattle, confirm other industry reports showing while U.S. home price growth appears to be slowing, market conditions portend a very competitive housing environment in 2022.

Industry Briefs Jan.12, 2022: nCino Completes Acquisition of SimpleNexus

nCino Inc., Wilmington, N.C., completed its acquisition of SimpleNexus, a cloud-based, mobile-first homeownership software company, for total consideration of 12.76 million shares of nCino common stock plus cash consideration of $270 million, on a cash-free, debt-free basis and excluding transaction expenses.