The Consumer Financial Protection Bureau released a report warning that millions of renters and their families may suffer previously avoided economic harms of the COVID-19 pandemic as federal and state relief programs end.

Tag: FHFA

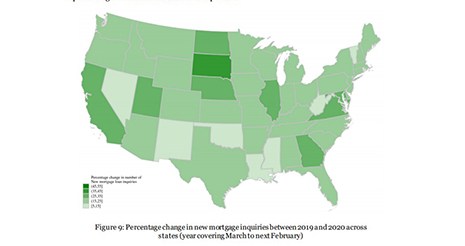

CFPB, FHFA Release Updated Data from National Survey of Mortgage Originations

The Consumer Financial Protection Bureau and the Federal Housing Finance Agency published updated loan-level data for public use collected through the National Survey of Mortgage Originations.

Industry Briefs Aug. 5, 2021

CoreLogic, Irvine, Calif., said its analysis of homebuyer migration trends in 2020 found coastal metro areas in Florida such as Lakeland and Tampa ranking highest, as many moved away from large coastal areas such as New York, Los Angeles and San Francisco.

MBA: GSE Compensation Should be Sufficient to Attract Best Talent

The most important asset Fannie Mae, Freddie Mac and the Federal Home Loan Banks have is their human capital, so their compensation must be sufficient to attract and retain top talent, the Mortgage Bankers Association said in a letter to the Federal Housing Finance Agency Tuesday.

MBA: GSE Compensation Should be Sufficient to Attract Best Talent

The most important asset Fannie Mae, Freddie Mac and the Federal Home Loan Banks have is their human capital, so their compensation must be sufficient to attract and retain top talent, the Mortgage Bankers Association said in a letter to the Federal Housing Finance Agency Tuesday.

FHFA Encourages Landlords to Apply for Emergency Rental Assistance Before Evicting Tenants

The Centers for Disease Control’s eviction moratorium expired July 31, but the Department of Agriculture, HUD, the Department of Veterans Affairs and the Federal Housing Finance Agency extended their foreclosure-related eviction moratoria until September 30. The agencies issued a joint statement encouraging landlords of properties backed by Fannie Mae or Freddie Mac to apply for Emergency Rental Assistance before starting the eviction process for non-payment of rent.

FHFA Encourages Landlords to Apply for Emergency Rental Assistance Before Evicting Tenants

The Centers for Disease Control’s eviction moratorium expired July 31, but the Department of Agriculture, HUD, the Department of Veterans Affairs and the Federal Housing Finance Agency have extended their foreclosure-related eviction moratoria until September 30. The agencies issued a joint statement Friday encouraging landlords of properties backed by Fannie Mae or Freddie Mac to apply for Emergency Rental Assistance before starting the process of evicting a tenant for non-payment of rent.

MBA Advocacy Update July 19, 2021

On Friday, FHFA announced the removal of the GSEs’ 50-basis-point adverse market fee in response to both industry advocacy and improved market conditions.

FHFA Eliminates 50 Basis Point ‘Adverse Market Refinance Fee’

The Federal Housing Finance Agency announced that Fannie Mae and Freddie Mac will eliminate the 50 basis point “Adverse Market Refinance Fee” for loan deliveries effective August 1.

FHFA Eliminates 50 Basis Point ‘Adverse Market Refinance Fee’

The Federal Housing Finance Agency announced today that Fannie Mae and Freddie Mac will eliminate the 50 basis point “Adverse Market Refinance Fee” for loan deliveries effective August 1.