Five federal agencies yesterday issued a proposed regulation that would codify a 2018 guidance clarifying that supervisory guidance does not have “force and effect of law.”

Tag: Federal Reserve

MBA Advocacy Update Sept. 14, 2020

With Congress (most notably the Senate) unable to reach consensus on the passage of any additional COVID-related economic relief, MBA sent a letter last Tuesday to the CFPB responding to the Bureau’s proposed rule revising the General QM definition. The letter explains MBA’s support for the price-based QM construct, and offers several recommendations to help ensure the rule meets its stated goals of robust consumer protections and broad access to sustainable credit.

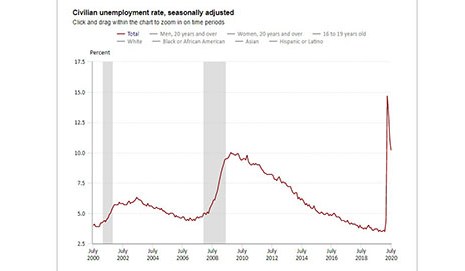

July Jobs Up Nearly 2 Million; Unemployment Rate Drops

The Bureau of Labor Statistics reported nonfarm payroll employment increased by 1.8 million during July, pushing the unemployment rate down to 10.2 percent.

All Eyes On Washington: What Will the Next Stimulus Bill Do for CRE?

Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, joined Walker & Dunlop Chairman and CEO Willy Walker on July 29 to discuss the stimulus bill being crafted in Washington, D.C. and its impact on the multifamily, mortgage and commercial real estate industries.

MBA, Affiliate Groups Submit Main Street Lending Program Recommendations

The Mortgage Bankers Association and affiliated groups shared recommendations with the Senate Banking Committee to improve the Main Street Lending Program’s effectiveness for commercial real estate owners and tenants.

MBA, Trade Groups Submit Main Street Lending Program Recommendations

The Mortgage Bankers Association and affiliated groups shared recommendations with the Senate Banking Committee to improve the Main Street Lending Program’s effectiveness for commercial real estate owners and tenants.

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

This week in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancelation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

Tom Lamalfa: May 2020 Survey of Secondary Market Executives

What follows are findings from a survey of senior mortgage executives I conducted in the first half of May. Due to cancellation of MBA’s National Secondary Market Conference, this survey was completed over the phone rather than face to face, as has been the case in the 23 preceding surveys done since 2008. Normally the surveys are conducted at the secondary conference as well as at the MBA Annual Convention every October.

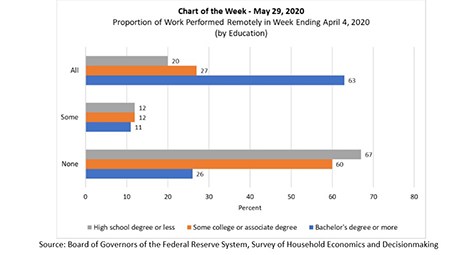

MBA Chart of the Week: Proportion of Work Being Performed Remotely

MBA’s Chart of the Week three weeks ago (May 8) focused on the U.S. Bureau of Labor Statistics’ bleak April report on employment conditions. We examined which industries and sectors have been hardest hit by the COVID-19 pandemic. This week, we continue our examination of the labor market using new survey data released by the Federal Reserve Board, and examine, by education level, how many people were able to work from home as the crisis deepened in early April.