The Mortgage Bankers Association responded to the Federal Housing Administration’s Request for Information concerning Buy Now Pay Later debt.

Tag: Federal Housing Administration

MBA Statement on FHA’s Annual Report to Congress

MBA President and CEO Bob Broeksmit, CMB, issued the following statement regarding the Federal Housing Administration’s release of its annual report to Congress.

FHA Establishes New Payment Supplement Loss Mitigation Home Retention Solution

The Federal Housing Administration on Wednesday published a Mortgagee Letter establishing a new Payment Supplement loss mitigation home retention solution.

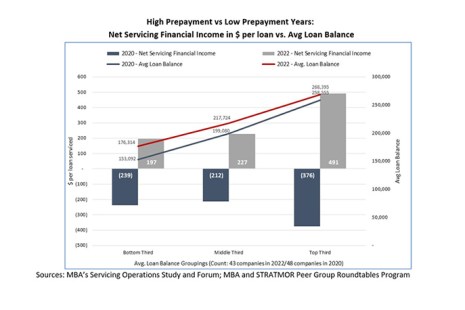

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

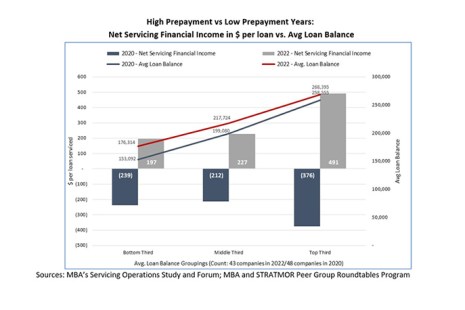

MBA White Paper Measures the Impact of Loan Sizes on Profitability Through Mortgage Cycles

The conventional wisdom is that originating and servicing higher balance loans means higher profits. However, according to a new white paper by the Mortgage Bankers Association titled, How do Mortgage Revenues, Costs and Profitability Vary by Loan Balance? An Analysis Using Benchmarking Data, the relationship between loan balance and profitability is more nuanced and may change over the course of market cycles.

Housing Market Roundup: Feb. 21, 2023

Here’s a summary of recent housing industry articles that have come across the MBA NewsLink desk:

FHA Seeks Input on 203(k) Rehab Mortgage Insurance Program

The Federal Housing Administration this week published a Request for Information in the Federal Register seeking public comments on ways it can enhance its Single-Family 203(k) Rehabilitation Mortgage Insurance Program.

FHA Publishes Updated Instructions for Single-Family Mortgage Model Documents

The Federal Housing Administration on Friday published Mortgagee Letter 2023-01, Updated Instructions for Single Family Forward Mortgage Model Documents for Government Sponsored Enterprises Security Instrument and Note Updates.

#MBAAnnual22: Ginnie Mae, FHFA, FHA Go Big

NASHVILLE—Presentations by government agencies at major events such as the Mortgage Bankers Association’s Annual Convention & Expo can be pretty staid affairs. Not so this year. On Monday, Ginnie Mae, the Federal Housing Finance Agency and FHA made one major announcement after the other, literally creating their own news cycle.

Housing Market Roundup Aug. 22 2022

Here’s a quick summary of housing/real estate finance articles that have come across the MBA NewsLink desk: