The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.

Tag: Fannie Mae

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.

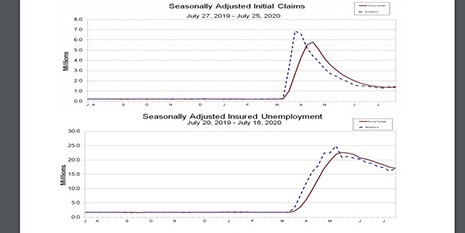

Initial Claims Rise for 2nd Straight Week

After improving—relatively speaking—through most of the spring, initial claims backslid for the second consecutive week, the Labor Department reported yesterday.

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.

Dealmaker: Hunt Real Estate Capital Provides $37M in Fannie Mae, Freddie Mac Funds

Hunt Real Estate Capital, New York, provided $37.2 million in Fannie Mae and Freddie Mac funds for Texas and Minnesota multifamily properties.

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.

Fannie Mae: Helpful eMortgage Resources

With the recent shift many people have experienced to remote work, digital closing options are top of mind for lenders. Fannie Mae has a variety of eMortgage resources to help you.

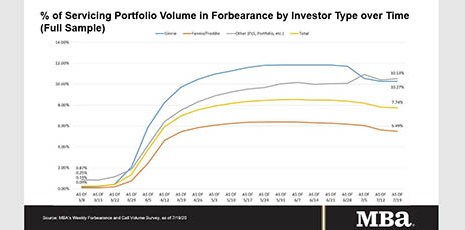

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

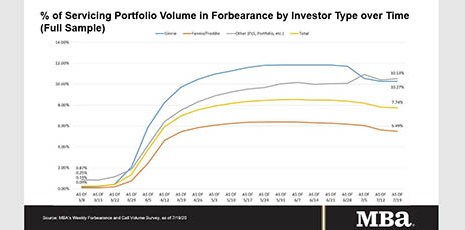

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

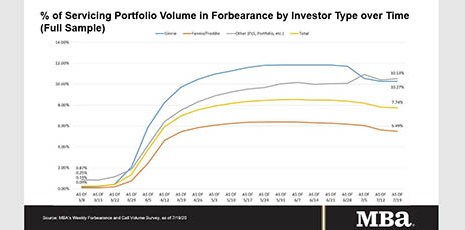

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.