Inlanta Mortgage, Pewaukee, Wis., announced it launched the OptifiNow CRM and automated marketing platform to improve its branch development and recruiting efforts.

Tag: Fannie Mae

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association on Thursday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.

MBA Mortgage Action Alliance ‘Call to Action’ Targets GSE Refi Fee

In the wake of new directive by Fannie Mae and Freddie Mac to impose a 50 basis point “Adverse Market Refinance Fee” on most refinance mortgages, effective Sept. 1, the Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ urging its 50,000 members to contact their members of Congress and the Federal Housing Finance Agency to roll back the directive.

MBA, Trade Groups Issue Joint Statement on GSE Adverse Market Fee

The Mortgage Bankers Association yesterday joined a broad coalition of organizations representing the housing, financial services industries as well as public interest groups issued the following statement on the GSEs’ new adverse market fee.

MBA Education TRID Implications of GSE Loan Level Price Adjustment Announcement Webinar Today

Join MBA policy staff and industry experts this afternoon for a critical discussion on the impact of Wednesday’s GSE announcement on TRID disclosures. While this topic will continue to evolve in the coming days, attendees can expect to learn about the immediate concerns and questions that will most likely impact your business and processes.

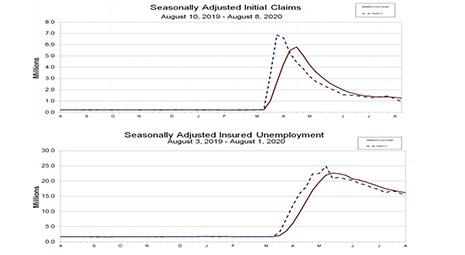

Initial Claims Fall Under 1 Million, Remain Historically Elevated

For the first time since the economic effects of the coronavirus took hold, new applications for unemployment fell below one million, although they remain elevated by historic standards.

MBA Mortgage Action Alliance ‘Call to Action’ Targets GSE Refi Fee

In the wake of new directive by Fannie Mae and Freddie Mac to impose a 50 basis point “Adverse Market Refinance Fee” on most refinance mortgages, effective Sept. 1, the Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a ‘Call to Action’ urging its 50,000 members to contact their members of Congress and the Federal Housing Finance Agency to roll back the directive.

Industry Briefs Aug.14, 2020

Inlanta Mortgage, Pewaukee, Wis., announced it launched the OptifiNow CRM and automated marketing platform to improve its branch development and recruiting efforts.

MBA Objects to GSE ‘Adverse Market Refinance Fee’

The Federal Housing Finance Agency yesterday authorized Fannie Mae and Freddie Mac to impose an “Adverse Market Refinance Fee”—a 50 basis-point fee on most refinance mortgages, effective Sept. 1. The after-hours announcements drew a strong rebuke from the Mortgage Bankers Association.

Industry Briefs Aug.13, 2020

Inlanta Mortgage, Pewaukee, Wis., announced it launched the OptifiNow CRM and automated marketing platform to improve its branch development and recruiting efforts.