On Tuesday, the Federal Housing Finance Agency announced steps to limit the impact on both lenders and consumers of its newly issued 50-basis-point GSE Adverse Market Refinance Fee. Following two weeks of sustained MBA-led advocacy with its coalition partners, FHFA delayed the implementation date of the fee from September 1 to December 1.

Tag: Fannie Mae

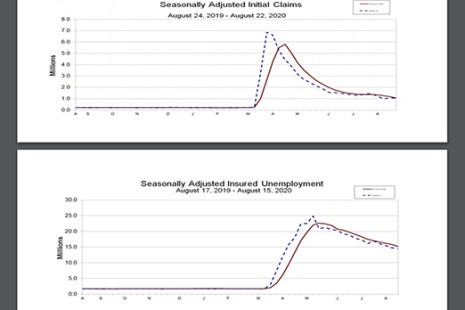

Initial Claims Dip But Hold Above 1 Million

Initial unemployment claims for the week ending Aug. 22 fell slightly from last week but remained above one million, as the economic recovery from the coronavirus pandemic continues to prove difficult.

GSEs, FHA Extend Foreclosure/REO Eviction Moratoria

The government-sponsored enterprises and HUD yesterday announced they would extend foreclosure moratoria to all GSE-backed mortgages and FHA-backed mortgages, respectively and extend eviction moratoria through at least Dec. 31.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced yesterday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced this afternoon that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

FHFA Delays Refi Fee Implementation to Dec. 1

The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

July New Home Sales Hit 13-Year High

Sales of new single-family houses in July posted another strong double-digit gain, jumping to their strongest pace since 2006, HUD and the Census Bureau reported yesterday.