The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

Tag: Fannie Mae

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

MBA: Loans in Forbearance Fall to 5-Month Low

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

Industry Briefs Sept. 18, 2020

ACES Risk Management (ARMCO), Denver, a provider of management and control software for the financial services industry, completed its rebranding effort to align the company’s image with its expanded focus on quality and risk management for banks and credit unions, as well as independent mortgage lenders.

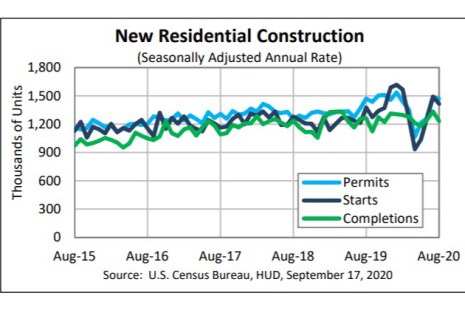

After Strong Summer, August Housing Starts Underwhelm

Housing starts—one of the bright spots in a red-hot summer housing market—faltered in August, HUD and the Census Bureau reported yesterday, although most of the decline took place in multifamily.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.

GSEs: Recession-Era QC Has Lenders Well-Prepared for Current Crisis (MBA LIVE)

Speaking virtually at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum, GSE analysts said despite challenges resulting from increased volumes, economic instability and a sharp spike in unemployment–as well an abrupt shift to remote working–lenders have shown adaptability and a commitment to loan quality.

Dealmaker: M&T Realty Capital Corp. Provides $124M for Multifamily

M&T Realty Capital Corp., Baltimore, closed $123.9 million in Fannie Mae and Freddie Mac multifamily loans.

Housing Report Roundup: Refi Candidates at Record High; Lenders’ Profit Outlook Improves; Homebuyers Undeterred by High Prices

Here’s a roundup of recent housing finance market reports, from Black Knight, Fannie Mae and Redfin.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.01%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.