The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.

Tag: Fannie Mae

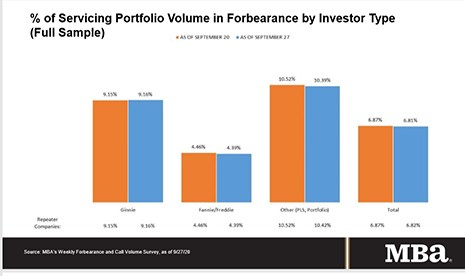

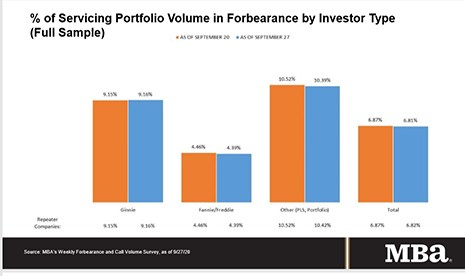

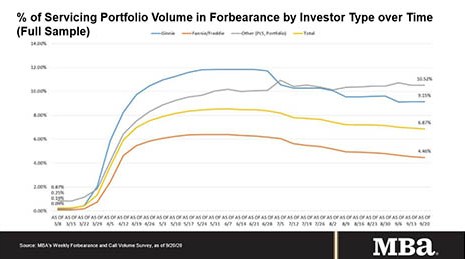

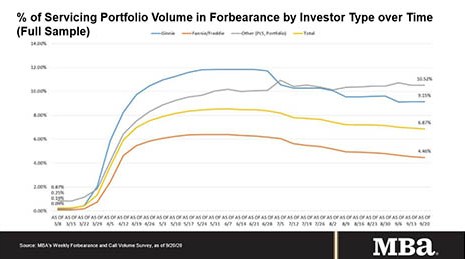

MBA: Share of Loans in Forbearance Falls to 6.81%

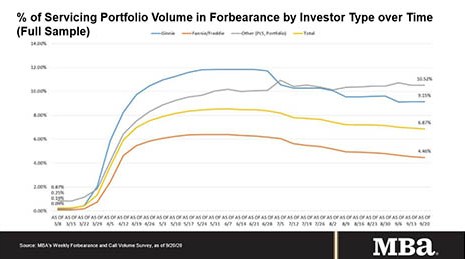

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Falls to 6.81%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

Industry Briefs Oct. 6, 2020

OptifiNow, Seal Beach, Calif., a provider of CRM and marketing automation, announced a partnership with cloud-based presentation platform, Digideck, Minneapolis. The partnership enables users of OptifiNow to send personalized presentations to prospects and customers.

Industry Briefs Oct. 5, 2020

OptifiNow, Seal Beach, Calif., a provider of CRM and marketing automation, announced a partnership with cloud-based presentation platform, Digideck, Minneapolis. The partnership enables users of OptifiNow to send personalized presentations to prospects and customers.

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 6.87%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

FHA: GSEs Complete 252,000 2Q Foreclosure Preventions

The Federal Housing Finance Agency said Fannie Mae and Freddi Mac completed 252,014 foreclosure prevention actions in the second quarter, bringing to 4.68 million the number of troubled homeowners who have been helped during conservatorships.

August New Home Sales Continue Summer Surge

New home sales topped the one million mark, seasonally adjusted, in August for the first time since 2006, HUD and the Census Bureau reported yesterday.