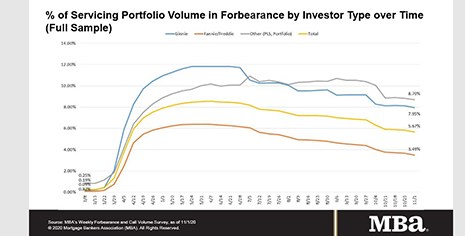

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Tag: Fannie Mae

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Multifamily Market Musings: Conversation with Fannie Mae’s Kim Betancourt, CRE

This year’s industry developments are dominated by the pandemic as well as associated social, political and economic impacts. Given this backdrop and the continued role of the GSEs in financing multifamily throughout market ups and downs, MBA NewsLink talked with Fannie Mae’s Kim Betancourt to get perspective on trends and what to watch as the multifamily market continues to evolve.

Dealmaker: Capital One Closes $296M in Freddie Mac, Fannie Mae Loans

Capital One, Bethesda, Md., provided $296 million in Freddie Mac and Fannie Mae loans in Texas and Virginia.

Dealmaker: Walker & Dunlop Arranges $107M

Walker & Dunlop, Bethesda, Md., arranged $107.2 million for multifamily properties in Florida and Pennsylvania.

New Home Sales Fall for First Time Since Spring

September new home sales fell for the first time in five months, HUD and the Census Bureau reported yesterday.

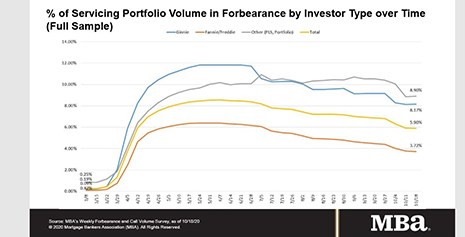

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.