The Federal Housing Finance Agency released its annual Performance and Accountability Report, which details FHFA’s activities as regulator of the Federal Home Loan Bank System and as regulator and conservator of Fannie Mae and Freddie Mac during fiscal year 2020.

Tag: Fannie Mae

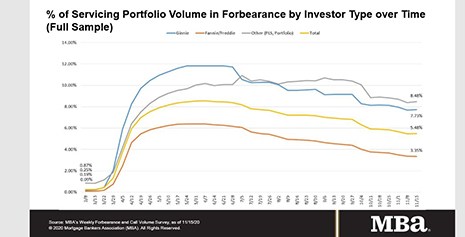

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Edges Up to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

FHFA Sets Final Rule for GSE Regulatory Capital Framework

The Federal Housing Finance Agency yesterday released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.

FHFA Sets Final Rule for GSE Regulatory Capital Framework

The Federal Housing Finance Agency yesterday released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.

FHFA Sets $70 Billion 2021 GSE Multifamily Loan Purchase Caps

The Federal Housing Finance Agency on Tuesday announced 2021 multifamily loan purchase caps for Fannie Mae and Freddie Mac at $70 billion for each Enterprise, totaling $140 billion in support to the multifamily market.

FHFA Sets $70 Billion 2021 GSE Multifamily Loan Purchase Caps

The Federal Housing Finance Agency yesterday announced 2021 multifamily loan purchase caps for Fannie Mae and Freddie Mac at $70 billion for each Enterprise, totaling $140 billion in support to the multifamily market.

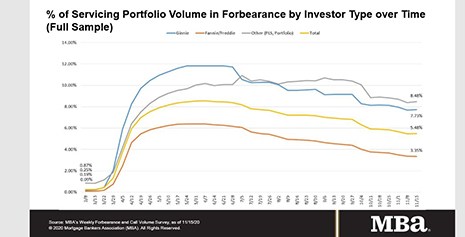

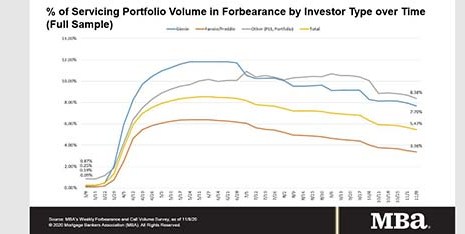

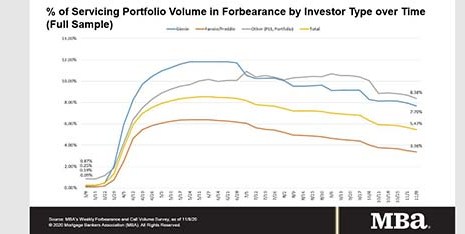

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

Industry Briefs Nov. 13, 2020

Qualia, San Francisco, launched its Physical Document Service, enabling mortgage lenders to automate management of paper trailing documents from title partners through Qualia.