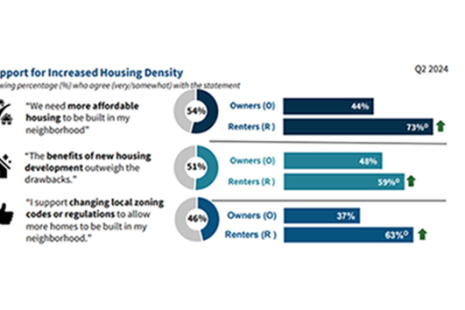

Far more consumers say affordable housing is harder to find than a few years ago, but more than half believe house prices, rent and local taxes will increase if more homes are built in their neighborhood, a recent Fannie Mae survey found.

Tag: Fannie Mae

Fannie Mae: Consumers Feeling Better About Housing Despite High Home Prices

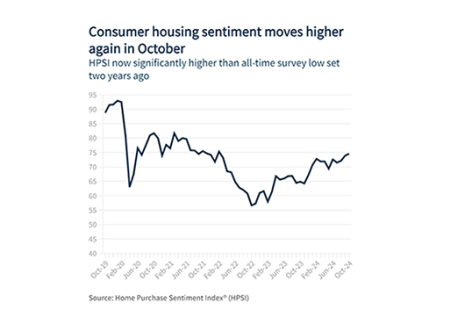

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index increased 0.7 points in October to 74.6, pushing the measure of consumer confidence to its highest level since February 2022.

Freddie Mac’s Mike Hutchins Announces LPA Update; Talks Tech, Repurchases With Fannie Mae’s Priscilla Almodovar

DENVER–Freddie Mac President Mike Hutchins announced Oct. 28 the latest addition to the enterprise’s automated underwriting system (Loan Product Advisor): LPA Choice.

MBA Statement on FHFA Updates on Loan Repurchases, Appraisals, and Pricing

DENVER–MBA President and CEO Bob Broeksmit, CMB, issued the following statement on today’s Federal Housing Finance Agency (FHFA) announcements on loan repurchases, appraisals, and pricing at MBA’s 2024 Annual Convention and Expo.

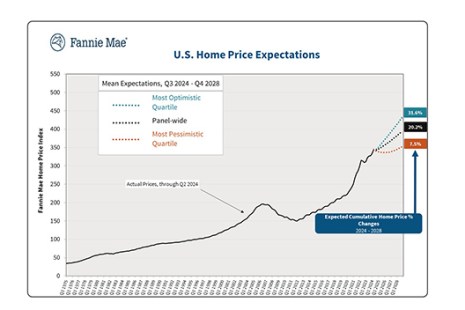

Fannie Mae: Home Price Growth Slows, Remains Robust

Single-family house prices increased 5.9% from third-quarter 2023 to third-quarter 2024, a deceleration from the previous quarter’s 6.4% annual growth rate, according to Fannie Mae, Washington, D.C.

Fannie Mae Finds Housing Confidence Inching Higher

Fannie Mae, Washington, D.C., reported its Home Purchase Sentiment Index increased 1.8 points in September to 73.9–its highest level in more than two years–as consumers are optimistic mortgage rates will decline further.

Mortgage Industry Assisting Homeowners Affected by Hurricane Helene

(Updated with new information Oct. 7) This is a developing story that will be updated. If you are aware of an effort by a mortgage company to provide relief or help to areas affected by Hurricane Helene, either directly or via fundraisers or donations, please contact us.

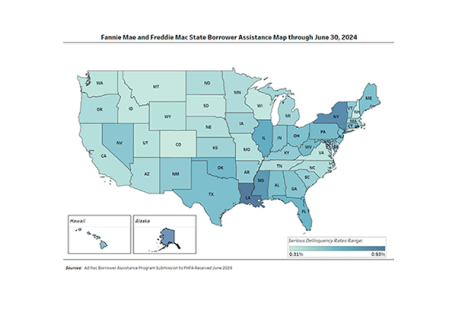

FHFA Reports More Than 7 Million Foreclosure Prevention Actions During GSE Conservatorships

The Federal Housing Finance Agency reported that Fannie Mae and Freddie Mac completed 46,378 foreclosure prevention actions during the second quarter, raising the total number of homeowners who have been helped to 7,004,262 since the start of conservatorships in September 2008.

Fannie Mae HPSI Up Slightly in August

Fannie Mae released the results of its Home Purchase Sentiment Index for August, finding it increased 0.6 points to 72.1.

Fannie Mae Panel Predicts Home Price Growth Will Decelerate in 2024, 2025

A panel of housing experts forecasts annual national home price growth of 4.7% in 2024 and 3.1% in 2025, according to the third-quarter Fannie Mae Home Price Expectations Survey.