The Mortgage Bankers Association said it is concerned over new limits on loan deliveries for second homes and investor properties by Fannie Mae and Freddie Mac.

Tag: Fannie Mae

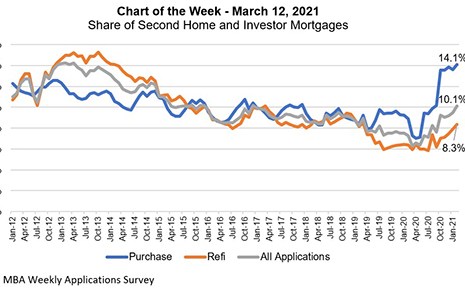

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

Housing Market Roundup: Mar. 12, 2021

Lots of housing market reports piling up in the MBA NewsLink inbox. Let’s get going:

Industry Briefs Mar. 12, 2021

HUD approved a Conciliation Agreement between JPMorgan Chase Bank and a Black woman, resolving the woman’s claim that the mortgage lender, relying on an appraisal that she believed was inaccurate, valued her home at an amount lower than its actual worth because of her race.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

MBA Letters Address GSE Liquidity Requirements, ‘Living Wills’

The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

FHFA Extends COVID-19 Multifamily Forbearance through June 30

The Federal Housing Finance Agency announced yesterday that Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through June 30, subject to the continued tenant protections FHFA imposed during the pandemic. The programs were set to expire March 31.

MBA Letter to FHFA Offers Recommendations on Appraisal Policies

The Mortgage Bankers Association, in a Feb. 26 letter to the Federal Housing Finance Agency, offered a set of recommendations aimed at promoting and modernizing the appraisal process.

FHFA Extends COVID-19 Forbearance Period/Foreclosure and REO Eviction Moratoriums; Aligns Mortgage Relief Policies Across Government

The Federal Housing Finance Agency on Thursday announced extensions of several measures to align COVID-19 mortgage relief policies across the federal government, a move that drew praise from the Mortgage Bankers Association.

2021 New Home Sales Off to Solid Start

The report said sales of new single-family houses in January rose to a seasonally adjusted annual rate of 923,000, 4.3 percent higher than the revised December rate of 885,000 and 19.3 percent higher than a year ago (774,000).