Redfin, Seattle reported that 68.4% of condos that sold in February did so for less than their original asking price.

Tag: Fannie Mae

Housing Sentiment Down Year Over Year for First Time Since 2023, Fannie Mae Finds

Fannie Mae’s Home Purchase Sentiment Index decreased 1.8 points in February to 71.6, driven largely by consumers’ increased pessimism that mortgage rates will go down in the next year.

Fannie Mae: Housing Sentiment Ticks Higher Despite Growing Affordability Concerns

The Fannie Mae Home Purchase Sentiment Index increased 0.3 points in January to 73.4, bouncing back slightly after falling last month for the first time since July. Year over year, the HPSI is up 2.7 points.

Home Price Growth Reaccelerates in Fourth Quarter, Fannie Mae Reports

Single-family home prices increased 5.8% between late 2023 and late 2024, an acceleration from the previous quarter’s 5.4%, according to the Fannie Mae Home Price Index.

Fannie Mae Reports Housing Sentiment Finishes 2024 Higher

Fannie Mae’s Home Purchase Sentiment Index decreased 1.9 points in December to 73.1 but remained substantially higher than year-ago levels due in part to ongoing mortgage rate optimism.

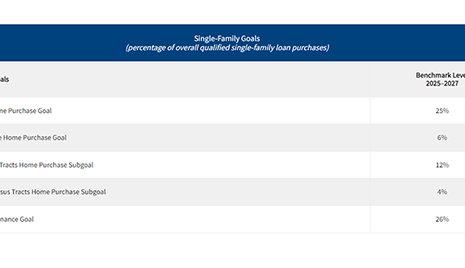

FHFA Finalizes 2025–2027 Housing Goals for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency issued a final rule Thursday establishing new affordable housing goals for the loan purchases of Fannie Mae and Freddie Mac over the next three years.

Housing Market Unlikely to Thaw Soon: Fannie Mae

Affordability and the so-called “lock-in effect” will likely keep housing activity subdued in 2025, according to the Fannie Mae Economic and Strategic Research Group.

Fannie Mae: Consumer Sentiment Rises in November

Fannie Mae released the results of its Home Purchase Sentiment Index for November, finding it rose 0.4 point to 75.

Fannie Mae Survey: Home Price Growth Deceleration Still Expected in 2025, 2026

Fannie Mae released its Home Price Expectations Survey. The respondents’ average outlook pointed to 5.2% growth in national home prices in 2024.

People in the News, Nov. 19, 2024

Industry personnel news from Dark Matter Technologies, Optimal Blue, MAXEX, MBA, Fannie Mae, FHFA, Certainty Home Lending and Provident Bank.