A slight drop in interest rates in January stabilized refinance activity and improved closing rates, said Ellie Mae, Pleasanton, Calif.

Tag: Ellie Mae

Industry Briefs

First American Financial Corp., Santa Ana, Calif., a provider of title insurance, settlement services and risk services for real estate transactions, and Docutech, a provider of document, eClose and fulfillment technology for the mortgage industry, signed an agreement for First American’s acquisition of Docutech.

Gen Z Displays Strong Appetite for Credit; Millennials Refinance Less (For Now)

TransUnion, Chicago, said Generation Z consumers—those born in or after 1995—are actively seeking credit despite many of them growing up during severe economic recessions in their respective global markets.

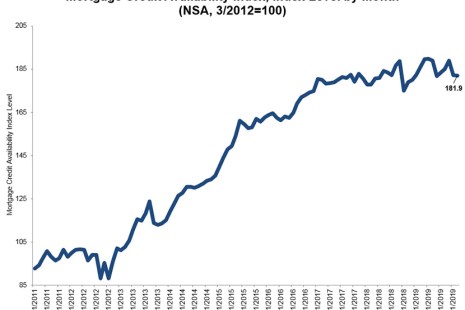

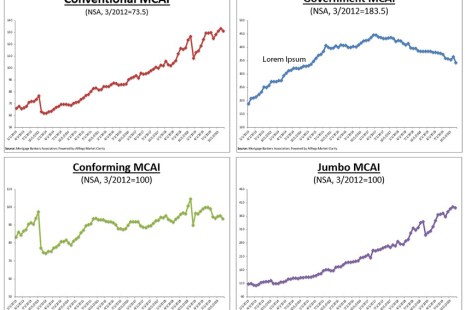

January Mortgage Credit Availability Takes Slight Dip

Mortgage credit availability fell slightly in January, the second straight monthly decrease after four months of increases, the Mortgage Bankers Association reported yesterday.

Ellie Mae: Interest Rate Rise Sparks Jump in Purchase Originations

The company’s monthly Origination Insight Report said purchase loans accounted for 54 percent of total closed loans in December, up from 51 percent in November and the 2019 low of 49 percent in September.

MBA: December Mortgage Credit Availability Decreases by 3.5%

Mortgage credit availability fell in December for the first time in four months, the Mortgage Bankers Association reported this morning.

Millennial Reports: Refi Activity Slows; Homeownership Barriers Persist

Reports from Ellie Mae, Pleasanton, Calif., and Clever Real Estate show millennials continue to struggle in the housing market.

Housing Market Update

Reports from ATTOM Data Solutions, Redfin, Zillow, RE/MAX and Ellie Mae.

Millennial Refinance Activity Hits 2019 Peak; Home Prices Growth Fastest in 6 Years

Ellie Mae, Pleasanton, Calif., said the share of refinances closed by millennials in October increased to a new high as interest rates on 30-year loans fell.

Residential Briefs

The Federal Housing Finance Agency will extend, from Dec. 19 to Jan. 21, 2020, the deadline for interested parties to provide input on potential changes to Fannie Mae and Freddie Mac Uniform Mortgage-Backed Security pooling practices.