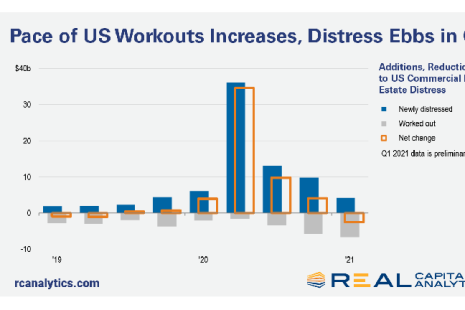

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Tag: Distressed Debt

Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Distressed Debt Monitor: CBRE’s Patrick Connell on the Role of Receiverships

2021 and beyond looks to be a marketplace defined by haves and have-nots with significant property type performance divergence both within and across property types. MBA Newslink interviewed CBRE’s Patrick Connell for some perspective on downturns and the role receiverships play in navigating the path to recovery.

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.