JLL Capital Markets, Chicago, completed $80 million in sales and secured $44 million in financing for Imperial Mariner, a four-building office/medical office campus in Brea, Calif.

Tag: Dealmaker

Dealmaker: MetroGroup Secures $23M for California 1031 Exchange

MetroGroup Realty Finance, Newport Beach, Calif., secured $22.6 million in financing for a southern California 1031 exchange transaction.

Dealmaker: Northmarq Completes $53M Build-to Rent Community Sale

Northmarq, Minneapolis, brokered the $53 million sale of a 144-unit Build-to-Rent Community in Mesa, Ariz.

Dealmaker: Gantry Secures $20M Office Refinance

Gantry, San Francisco, secured a $19.5 million permanent loan to refinance Esquire Plaza, a 22-story office tower in Sacramento, Calif.

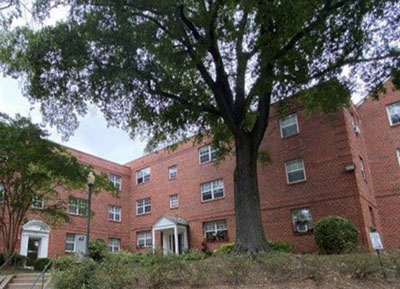

Dealmaker: Eastern Union Secures $40M for Virginia Multifamily

Eastern Union, New York, secured $39.7 million to refinance Washington & Lee Apartments, a 369-unit multifamily community in Arlington, Va.

Dealmaker: JBM Brokers $115M Florida Apartment Sale

JBM Institutional Multifamily Advisors, Naples, Fla., brokered a Class A southwest Florida multifamily property sale for $115 million.

Dealmaker: Comstock, Berkadia Secure $78M Refinancing

Comstock Holding Cos., Reston, Va., jointly structured a 10-year, 4.5% fixed-rate $77.5 million loan with Berkadia Commercial Mortgage, New York, to refinance Phase II of Comstock’s Loudoun Station in northern Virginia.

Dealmaker: CBRE Secures $56M for South Carolina Warehouse

CBRE, Dallas, secured $55.5 million in acquisition financing for Gaffney Distribution Center, a one-million-square-foot warehouse in Gaffney, S.C.

Dealmaker: M&T Realty Capital Corp. Provides $22M for Ohio Affordable Housing Property

M&T Realty Capital Corp., Baltimore, provided a $21.5 million bridge loan for a 337-unit affordable housing property in Athens, Ohio.

Dealmaker: NewPoint Secures $12M for Affordable Housing Construction

NewPoint Real Estate Capital, Plano, Texas, provided $12 million in construction financing for The Flats at 402, a 54-unit affordable housing community to be built in Madison, Wis.